Can you name a ~CAD$40M market cap gold junior exploration company with an existing operating mill, 2 Moz resource, and an estimated 65,000 oz of Au through a combination of material on the pad, in stockpile, and near-surface minable reserve????

Proven Company & Mine Builders

Management has continually demonstrated an impressive record of transforming under-capitalized and under-explored assets into top-tier projects. The team brings a solid background of building companies and mines with the likes of Tony Makuch (Chairman) and Bob Buchan (Director).

Existing Infrastructure and Brownfields Site

The Borealis Mine is a past producer that is fully permitted with an existing, functional, and producing heap-leach pad and ADR facility. BOGO has successfully poured gold on-site and will be doing so again later this year. We estimate ~$70M CAD in replacement value.

Organic Growth Strategy and Potential

The project currently hosts a historic M&I resource of ~1.9 Moz at 1.25 gpt Au and an inferred resource of 0.407 Moz at 0.34 gpt Au. Minimal exploration drilling has occurred on the property since 2012 despite compelling targets (67.1 m of 16.2 gpt Au) demonstrating oxide and high-grade sulphide expansion potential.

Attractive Valuation

Over the last year, BOGO successfully raised over CAD$15M, demonstrating its ability to raise substantial amounts of capital in a challenging and capital-starved market.

Tier 1 Jurisdiction

BOGO is situated in a proven jurisdiction and the center of gravity for global gold production. We believe Nevada still has significant geological potential without the geopolitical or permitting risk associated with other jurisdictions.

Investment Thesis

Borealis offers access to a proven mine building/operating team, with a project that comes with an extensive dataset that helps de-risk exploration through known targets. The valuation is underpinned by existing infrastructure (~$70M replacement value), a historic resource, and existing stockpiles ready to process and recover gold. Based on these attributes, BOGO provides downside protection while simultaneously offering asymmetric risk-reward based on “low-hanging fruit” targets that can be drilled imminently (67.1 m of 16.2 gpt Au or 1,087 gram*m Au) with the ability for incremental near-term cash generation.

Background

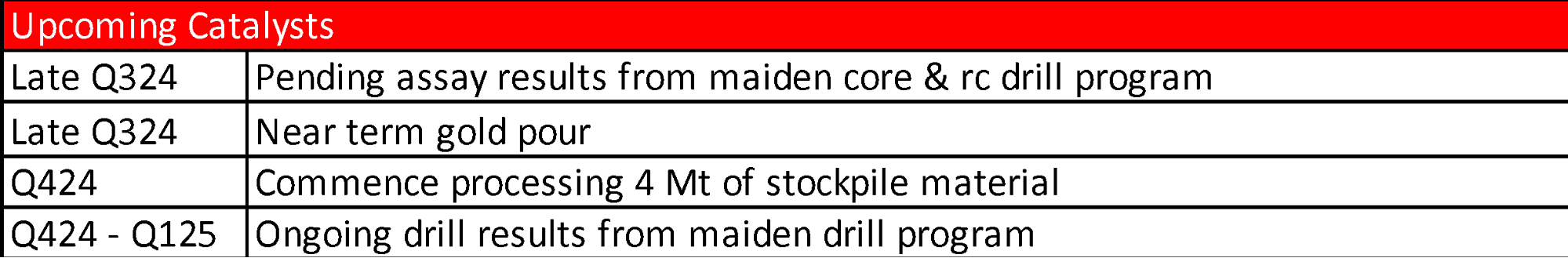

The Borealis gold project is an open-pit heap leach gold mine in Nevada located 26 km from the town of Hawthorne in the prolific Walker Lane Trend. Historically, the mine produced ~625,000 oz of gold until it was placed on care and maintenance due to legal issues. The property is ripe with exploration targets little to no testing and offers an opportunity for a quick start program based on all the historical work conducted. BOGO has already utilized existing infrastructure to demonstrate a potential small-scale production re-start by completing two gold pours from an existing heap leach pad but has also commenced a drill program focused on near-mine resource growth.

Proven Company & Mine Builders

The team’s diversity and experience offer an abundance of strengths in mine operation, mine re-development, and exploration suited exactly for a project like this. We highlight Chairman Tony Makuch’s success in the industry, developing and transforming Kirkland Lake (merged with Agnico Eagle to create a US$22.4B company) to over 1.5 Moz gold producer by improving operational efficiencies and exploration success. Kelly Malcolm (President & CEO) has a robust technical background, previously being involved in discovering Detour Gold’s 58N deposit and raising over CAD$90M in capital. Borealis is also backed by a formidable capital markets savvy board—Bob Buchan (founded Kinross), Greg Gibson (previously CEO of Sprott Mining), and Christina McCarthy (previously CEO of Paycore Minerals, which was acquired for CAD$91M). We believe the management team has the right skills to unlock value in the district through exploration and potential acquisitions.

Existing Infrastructure and Brownfields Site

The project consists of multiple open pit mines. The mined ore was crushed and processed through conventional cyanide-agglomerated heap leaching processes using permanent and reusable pads. The leach pads are still operational and produce gold via an adsorption, desorption, and refining (ADR) plant. The mine is connected to the NV energy grid and is fully permitted to produce 30,000 oz of Au a year (plant capacity up to 60 koz/year), but amending permits for expansion would not be difficult in a top-tier jurisdiction such as Nevada. An estimated 65,000 oz of Au through a combination of material on the pad, in stockpile, and near-surface minable reserves could be processed for supplemental revenue, minimizing near-medium term dilution. We re-iterate the estimated CAD ~$70M in replacement value.

Organic Growth Strategy and Potential

While the historical resource (~1.9 Moz at 1.25 gpt Au and an inferred resource of 0.407 Moz at 0.34 gpt Au) implies a significant sulfide component, minimal regional drilling was conducted to fully exploit the oxide potential by previous operators, as the focus at the time was on mine optimization.

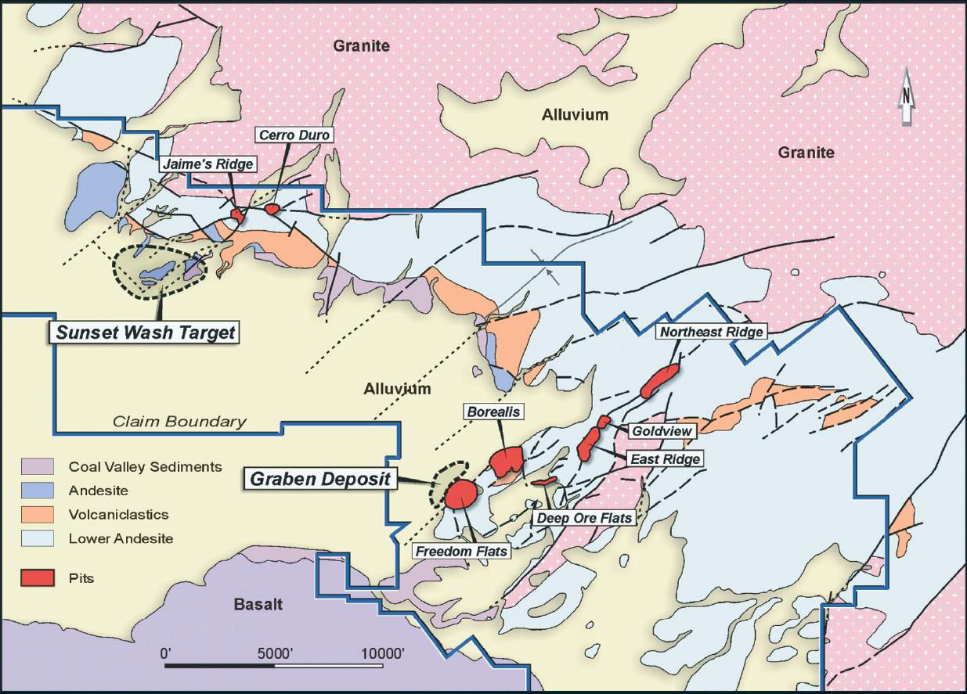

Recent drilling (~20 holes RC and core) has been aimed at following up drilling in and around the Borealis pit to test for additional oxides. Also, Jamie’s Ridge and Graben allow an opportunity to target low-hanging fruit by following up on holes that delivered 67.1 m of 16.2 gpt Au, 115.8 m of 4.5 gpt Au and 96.4 m of 5.3 gpt Au but were never thoroughly followed up to determine the boundaries of mineralization.

Historic mining was focused on eight separate pits oriented along NE-SW structures, but it was not until later that the potential for additional deposits under the alluvium was recognized. Recent work has demonstrated that the Sunset Wash Target has similar characteristics as the Graben deposit and Freedom Flats. This indicates potential for additional targets between Sunset Wash and Graben an area with a strike of 4.5 km has been overlooked due to alluvium cover.

Overlooked Asset

We estimate over US$30M was spent on the project historically on infrastructure, mining, and exploration (today’s replacement cost is estimated at CAD$70M), but due to litigation, which began in 2018, vendors have overlooked the project. Borealis Management has done well to acquire the property for ~half of the capital sunk into the project. Borealis granted an initial all-share payment for 19.9% (15.6M shares) of the company to Waterton, which has since been acquired by Rob McEwen (16%) and other shareholders. Additionally, staged payments totaling US$15M after achieving several long-term catalysts, including US$7.5M upon commercial underground production, are also part of the transaction. Prior to underground mining, the team will be focused on expanding the oxide resource by targeting areas such as East and NE Ridge, Deep Ore Flats, Jamie’s Ridge and Cerro Duro, where there is clear line of sight for resource expansion based on historical drilling and exploration work.

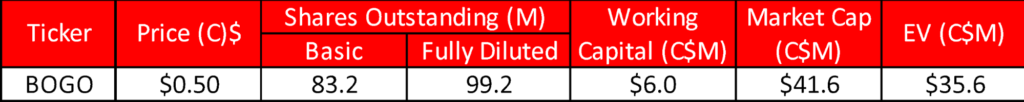

Current Valuation

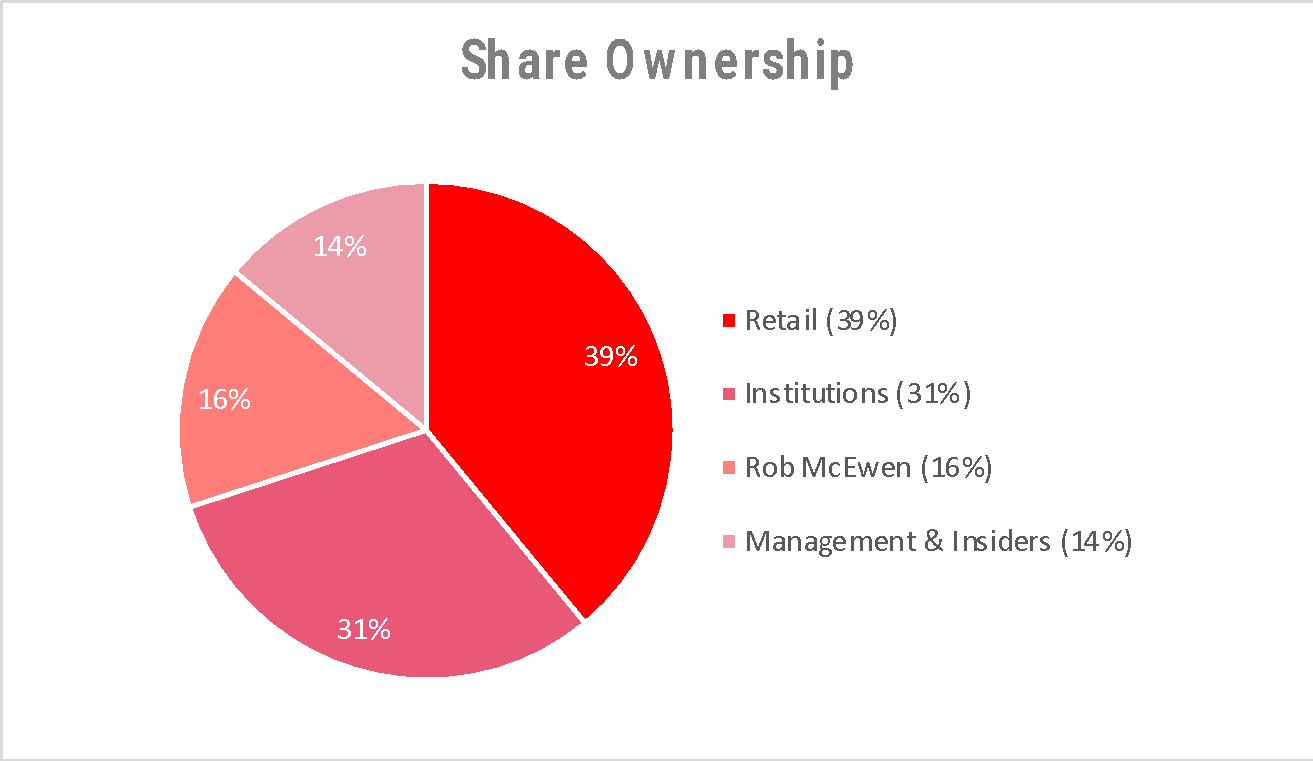

The company closed on over C$15M demonstrating its ability to raise substantial amounts of capital in a challenging and capital-starved market. The current valuation is ~C$41.6M market cap with 83M shares outstanding. Borealis is now trading as of August 7, 2024, under the ticker BOGO on the TSX Venture.

Upon listing, Insiders will own approximately 14%, Rob McEwen 16% (acquired from Waterton), 31% institutional ownership (including Earthlabs, Equinox Partners, Alpha North, K2, and Sachem Cove) and the remainder with retail signifying a tight share structure (28.5 M escrowed and subject to release over 36 mos & 13.5M escrowed and subject to release over 18 mos).

Tier 1 Jurisdiction

Nevada is elephant country when it comes to gold deposits, and Borealis is situated in the Walker Lane trend, which is home to the discovery of the Comstock Lode deposit, responsible for 8.5 Moz of gold. The project is located 15 km NE of Hecla’s Aurora Mine which historically produced 1.9 Moz of Au, and about 100 km W of Kinross’s Round Mountain Mine (16 Moz of historic production to date).

Summary

Investors are infrequently presented with opportunities that offer such compelling asymmetric risk-reward scenarios as Borealis. Underpinned by a seasoned and proven management team, and existing resource with additional near-surface and high-grade depth potential, Borealis is primed for a re-rate opportunity through exploration and near-term resource growth. The company is currently valued at a fraction (CAD$41.6M) of the replacement cost of infrastructure (we estimate CAD$70M). Considering an estimated 65,000 oz of Au through a combination of material on the pad, in stockpile, near-surface minable reserves that could be processed for supplemental revenue minimizing near to medium term dilution, and we estimate CAD ~$70M in replacement value for infrastructure, alongside a +2 Moz resource—Borealis Mining is attractively valued and ripe for the picking.

Disclosure

Intrynsyc and its employees are minority shareholders of Borealis. Intrynsyc has acted as an advisor to Borealis since 2023.