Company Overview

Imperial Helium (IHC-V) is an early-stage helium exploitation, production, and refining company focused on land acquisition in Southern Alberta Sweetgrass Arch (Beaverhill Lake formation). By reviewing thousands of gas wells’ existing data, Imperial Helium’s experienced management team has identified 2,000 wells with >=0.5% helium concentration that are likely economically viable. The company has leased approximately 24k hectares around its founding asset estimated at 1.0Bcf recoverable helium across 6.5k hectares. Using the Bureau of Land Management’s (BLM) Helium reserve sale from 2018 along with managements insights, we put the value of Imperial Helium’s estimated 1.02Bcf resource between US$255M ($250/mcf) and US$350M ($350/mcf) with the potential to double via land acquisition within the same formation. Imperial Helium is expected to trade on Friday, May 21st on the TSX Venture exchange under the ticker IHC.

Key Takeaways

While the helium market remains obscure and actual sales data difficult to find, research indicates prices for Grade-A helium ranging from US$250/Mcf to $3,200M/Mcf (Desert Mountain).

200Bcf gas resource with an estimated 1.0Bcf of recoverable helium across 24k hectares valuing the company’s resource at US$250M-$350M.

3Bcf of Helium capacity is expected to be brought online as a byproduct of LNG production over the next few years. Most of these additions are in high-risk geopolitical countries (Algeria, Qatar, Russia), exposing helium to potentially significant supply shocks.

Talented management team experienced in the helium space within the WCSB with an attractive founding asset to build from.

At 6Bcf/yr consumption the TAM sits around US$1.5Bn to US$2Bn and is expected to grow at a CAGR between 3-6% over the next decade.

Conclusion

Helium has come under intense scrutiny due to the current supply glut and prices have risen steeply. Exploration and development companies, both mining and oil and gas, have taken notice as evident by the various companies transitioning to focus on helium exploration, exploitation, and development. While we think Imperial Helium has done a great job de-risking their initial helium play, there is a risk to the thesis in that planned additional helium production capacity in risky locations comes online in their allotted timeframe and within a few years supply is ahead of demand.

We still like Imperial Helium in this case, as a lower cost producer we estimate it can be profitable at helium prices below $100/Mcf and adds value with its premium Grade-A helium and secure and stable production with cheaper access to the world’s largest consumer, the United States. They plan to drill conventional wells (cheap), in a non-sour gas, non-liquid’s rich location (unlike Duvernay) that makes for simpler helium processing and sales.

Deeper Dive – Company and Market Analysis

Company Snapshot

Dr. David Johnson leads the Imperial Helium team with over 35 years in Canadian exploration and production working with Shell Canada, ExxonMobil, Kuwait Oil Company, and others. The COO, Michael Zubkow, has 45 years’ experience as a professional engineer with expertise in drilling, completions, and facilities design. Imperial Helium has onboarded specialists in helium through their “Alliance Agreement” by partnering with Petrel Robertson (geoscience consulting), Cronin Capital, Uniper (helium downstream/upstream market expertise), and ON2 (helium process experts) to ensure their near-term milestones are concrete.

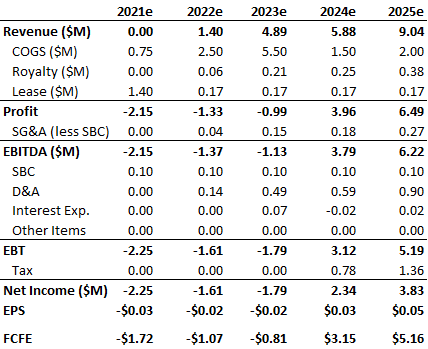

On February 18th, 2021 the company completed their go-public round raising $14M at $0.25/unit (1/2 warrants at $0.375). Looking at the capital structure, the management team will own approximately 8.4% of the 85M outstanding common shares. On a fully diluted basis, insiders will make up about 19.3% ownership on 139M shares assuming conversion of performance shares and options. The company has no debt.

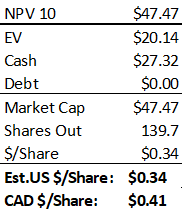

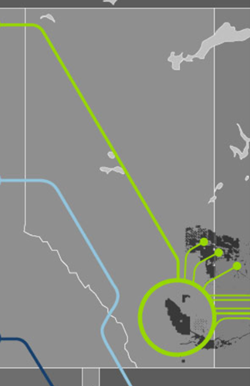

Valuation

Given the inherent risks in a start-up exploration and production company we used both a NPV10 method to net an intrinsic value of CAD $0.67/share on a non-diluted basis post-raise ($0.41/share post-dilution). With the additional resources that management expects to add through its leased properties we think there is ample upside from our valuation. Our model predicts first revenue in FY2022, capex to full-scale pilot projects in FY2023, and additional plant expansions in FY2026.

The Company

Business Model

Current demand for helium is outstripping production, and geo-political instability in regions where helium resources are significant, such as Qatar, have made it difficult for distributors and consumers to have confidence in their supply chains. While contracts remain private, it is estimated that both crude and Grade-A helium prices have tripled in the last few years due to production shortfalls, the embargo on Qatar, and growth of dependent technologies. Prices will likely remain high until new production capacity is brought online.

Making things less transparent, the refining and distribution of helium is run as an oligarchy with Air Products & Chemicals (APCI), Linde Global Helium (bought Praxair in 2020), Air Liquide, and Matheson Tri-Gas making up approximately 90% of the market share of crude helium purchases. Since the main source of crude helium is typically as a biproduct of natural gas extraction, the above companies often partner with large oil and gas players to establish long-term offtake agreements in locations where helium concentrations are expected to be high.

Imperial Helium has secured lease agreements for 24k hectares of land that are sitting on an estimated reserve of 1.02MMcf of recoverable helium gas valued at $250-$300M. By accessing existing geological data from previously drilled oil and gas wells, Imperial Helium de-risked the exploration costs on their first big play and has identified what they think is a premium location with proven dry, high-flowrate gas wells in the western-most section of the Sweetgrass arch. Targeted locations have had lower interest from typical oil and gas producers due to the lower value product mix of the wells, so often any existing assets can be picked up at a significant discount and infrastructure such as roads and power are already built. Management thinks there is potential to meaningfully increase the total recoverable amount of helium in the additional land leased around their current play.

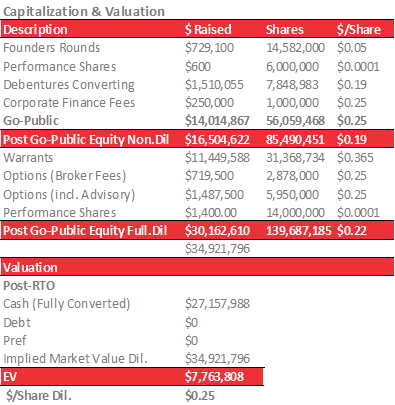

Figure 1: Heritage Royalty Alberta Assets

Imperial helium will complete their “Work Program” of seismic and drilling of an initial well in the second quarter of 2021, and if successful, tie-in a smaller scale production facility to validate their Grade-A helium refining process and confirm the economic viability of helium production. Our current estimates show that Imperial Helium’s cost per Mcf initially is high due to the pilot project and planned plant, but over the next few years, breakeven costs stabilize around $70/Mcf, which provides significant return on investment when selling at $250-$300/Mcf.

Through their “Alliance Agreement” with ON2 Solutions (an engineering, procurement, and construction group), Imperial is far along the path of designing the facility and will begin construction of the pilot plant in the short term. The design will utilize two stages of separation after an inlet header, one being a molecular sieve and the other an electric-pressure swing adsorption system utilizing a magnetic field to refine Grade-A helium which sells for a significant premium over crude helium.

Due to the nature of the suppliers and distributor oligopoly, Imperial Helium plans to lock in an offtake agreement with a number of parties including a major supplier likely in Q3 of 2021 that will validate the business strategy and foundation the management team has laid.

Lastly, Imperial Helium will look to partner with existing oil and gas producers that currently flare or vent helium and provide them with helium separation and refining units using a revenue split as the incentive with potential carbon capture benefits as well.

The demand for helium will be strong post-COVID and the majority of additional production capacity until 2025 will be developed in geopolitically unstable countries. A North American source of helium is highly valuable from both a supply chain risk management perspective and a consumption perspective since the US currently makes up 30-40% of total global demand. In the next 5 years, 80% of planned new helium capacity coming online will be from Russia, the, the Middle East, and Africa, making any additional capacity from North American valuable with its lower expenses when compared to the high cooling and transportation costs coming from overseas.

With an initial asset estimate of 1Bcf of recoverable helium and the potential to significantly increase resources within the current leases, we think Imperial Helium is setting itself up to be a lower cost producer (conventional wells are cheap) of high grade and high margin helium in a time when helium prices have never been higher.

The Players

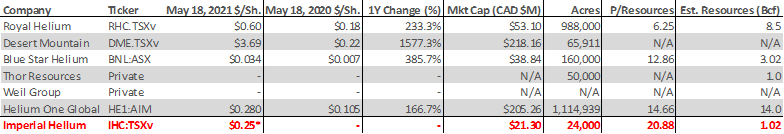

This is a budding competitive space in North America. Current comparables include:

E&P: Desert Mountain Energy (DME:TSXv), Royal Helium (RHC:TSXv), Weil Group (Private), First Helium (Private), North American Helium (Private), Blue Star Helium (BNL:ASX), and Thor Resources (Private).

There are some notable recent discoveries with significant estimated such as Renergen, who is drilling test wells on what could be a 100Bcf of resources in South Africa with an offtake agreement with Linde. The field contains up to 12% helium concentration, some of the highest in the world.

Helium One is exploring what they think could be a large resource in Tanzania and is intending to drill exploration wells in the first half of 2021 to determine the scope. The economic viability of the helium from this source is not well understood due to the proximity to volcanoes and potential of high contaminants in the gas that will require processing, but early analysis estimates the recoverable helium of about 14Bcf. Noble Helium is making a similar play in Tanzania and is targeting a production date of FY2025.

Midstream/Plant Operators: Quantum Helium Management (Private), IACX, Rocky Mountain Helium (Private), Tumbleweed Midstream (Private), and DCP Midstream

Distributors: Air Liquide, Air Products, Iwatani, Matheson Tri-Gas, Uniper, Linde, and Messer.

Royal Helium and First Helium are exploitation and development companies focused on Saskatchwan and Northern Alberta, and have raised significant capital in the last six months. Royal Helium has completed test wells in the Souris River Formation (similar to the Beaverhill Lake Group formation for Imperial Helium) resulting in 0.3-0.9% helium concentrations. The stock is up over 200% year over year. Royal Helium might be one of the better comparables when looking to see how Imperial Helium could trade.

First Helium is developing in the Peace River Arch in north-western Alberta and will have somewhat dissimilar well characteristics compared to the Sweetgrass Arch in that the typical “first rate decline” (how much production is lost in the first weeks as the well begins producing) is faster in the Peace River Arch region, and so additional make-up wells are required sooner than where Imperial Helium is focused resulting in a higher overall capex along with the potential for more liquid condensate and higher sour gas concentrations to process. From a capital markets perspective, First Helium recently raised $12M ahead of their expected IPO on the TSX Venture, oversubscribed from their target of $9M, showing strong investor demand. This could be an interesting one to watch once public to see how Imperial Helium is valued in comparison, as Imperial Helium is targeting Grade-A helium production and should have greater overall helium-related netback.

The Story of Helium

History

Helium is a colorless, odorless, non-toxic inert gas (part of the noble gas family) that has the lowest boiling point of all elements. While helium can be found freely in our atmosphere, it’s at such a low concentration, about 5ppm, that production at any type of scale is currently uneconomical. The largest and most consistent source of helium has been as a biproduct of oil and gas production. Helium is thought mostly to be created from natural radioactive decay from elements like thorium and uranium which radiate alpha particles (alpha particles consisting of 2 protons and 2 neutrons, aka He2+). Since helium is a very light gas, it moves upwards through the rock and permeates cracked formations often ending up trapped with natural gas in porous sedimentary rocks. Halite and anhydrite are the only sedimentary rocks that can block the upward migration of helium atoms due to their small atomic radius (0.2 nanometers), giving geologists unique features to look for in helium exploration.

Due to its properties, helium is considered a strategic asset by various nations, driven partially from its use by the military in airships in the 1920s and then from its use as a liquid rocket fuel for defense and space exploration. The US launched a helium conservation program in the 1960s that collected and stored helium in the Cliffside gas field in Texas – at its peak storing about a 1Bcf of gas. By 1996, congress decided to phase out the reserve, and the Bureau of Land Management (BLM) began selling down its reserves with the intention to be depleted in the early 2000s. The draw down saw various delays over the years and now the BLM expects it will empty its reserves by 2023; however, it ceased public auctions of crude helium in 2018.

Uses

Applications for helium have grown meaningfully in the past few decades, becoming a product that in most technologies cannot be readily substituted. About 20% of all helium demand comes from MRI machines that use liquid helium cooled to -269 °C and chill the magnets to superconducting levels. The most widely used magnets typically consume 0.02-0.14% of helium a day (7%-50% a year).

Welding, purging, and other “controlled atmosphere” applications make up another 20-30% of consumption. Helium is inert and therefore ideal for high temperature processes where a gas is used to shield from reacting with other elements (for example, oxygen), that can react under high temperatures and produce compromised welds. On top of shielding, helium also helps localize heat exposure due to its low conductivity. These properties make helium useful in the manufacturing of semi-conductors, fiber optics, various other electronics, and arc welding. Other interesting uses are in the medical field, including laparoscopy, where helium or carbon dioxide can be used to pressurize the abdomen during surgery and will diffuse out of the body after suturing. The remaining 50% or so is broken into <10% use cases such as lifting services, balloons, leak detection, laboratory and research work, and miscellaneous uses.

Global Reserves, Supply and Demand

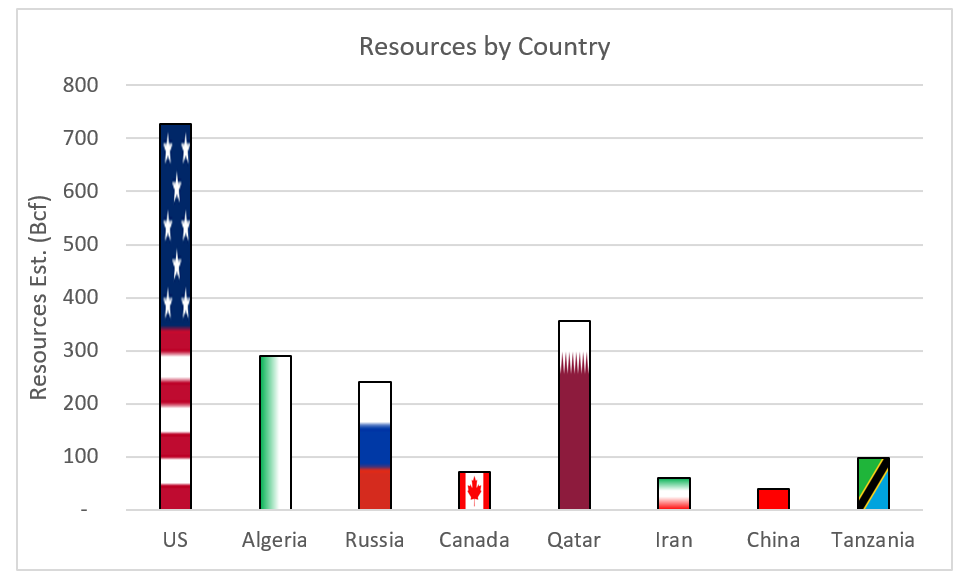

Figure 2 below shows the largest estimated resources in the top eight countries. The estimates are taken from a variety of sources, the most influential being the BLM helium report from 2012 and the U.S. Geological Survey, Mineral Commodity Summaries, February 2019. Note these are resources estimates, not reserves.

Tanzania has recently become home to what is thought to be the biggest single deposit of helium in the world with an estimated 98Bcf found in the East African Rift Valley by Helium One; however, we do not yet know what percentage of this helium will be economically viable along with additional risks, such as high sulfur contamination due to the deposit’s proximity to volcanoes.

Figure 2: Resources by Country

Iran has significant reserves, sharing the North Dome Gas condensate field with their southern neighbors Qatar, but they remain mostly underdeveloped in any type of capacity to extract and process helium.

Qatar produces a significant portion of the world’s helium as a biproduct from its large LNG facilities with capacity around 1.9Bcf/yr. This capacity has hasn’t been effectively utilized since 2017 when Saudi Arabia, UAE, Bahrain, Egypt, and others placed Qatar under an embargo. The embargo lifted in January 2021, so it’s safe to assume helium capacity will return to normal levels over the next year or so.

In the US, the BLM supplies the market through its reserves from which six main players refine the crude helium to produce Grade A helium. Air Products & Chemicals (APCI), Linde Global Helium (with Praxair Inc as subsidiary as of 2020) round out the largest portion of Garde A helium producers in the US that are connected to the BLM distribution. Exxon extracts helium sourced from the LaBarge field and refines it via the Shute Creek gas processing plant that provides almost 25% of all the helium produced in the US. Total capacity production from the US is about 4.9Bcf/yr.

Algeria would be the next largest producer with a capacity of 1.2Bcf/yr and has plans for an additional 0.43Bcf/yr expansion existing facilities online by 2022.

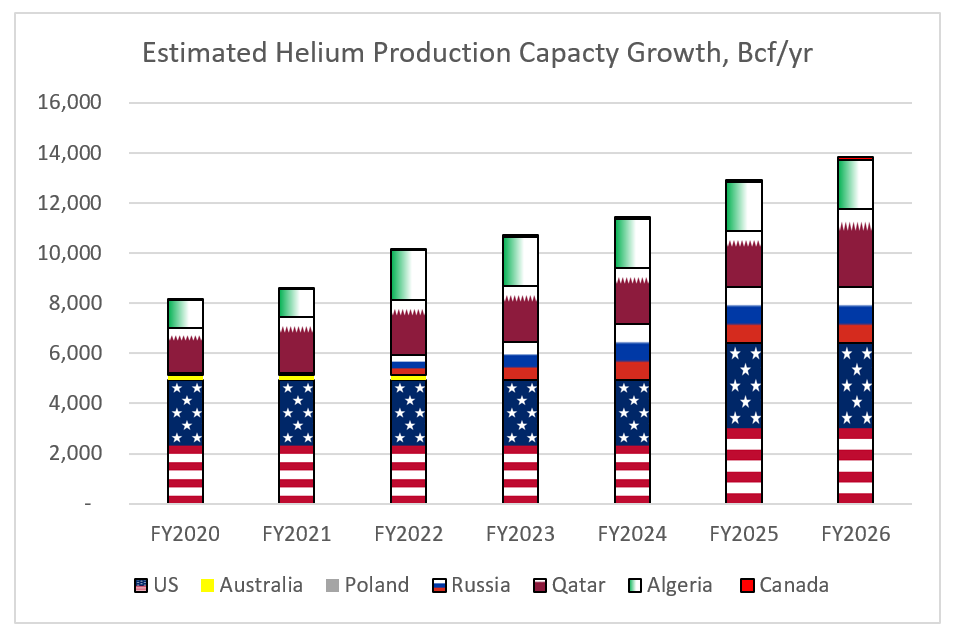

Russia currently has very limited capacity but plans to have a 2Bcf/yr capacity facility operating by 2022 and at capacity within a few years. Australia, Poland, and Canada round out the largest suppliers with <0.1Bcf/yr capacity.

Figure 3: Estimated Helium Production Capacity

While we can see from Figure 3 that the potential helium production capacity is expected to grow meaningfully by 50-60% by FY2025, it is extremely important to note that 83% of estimated new production capacity will come from “high-risk” geopolitical areas like Russia, Algeria, and Qatar, all who have had a history of missing start-up timelines and have higher non-systemic risks than their North American counterparts.

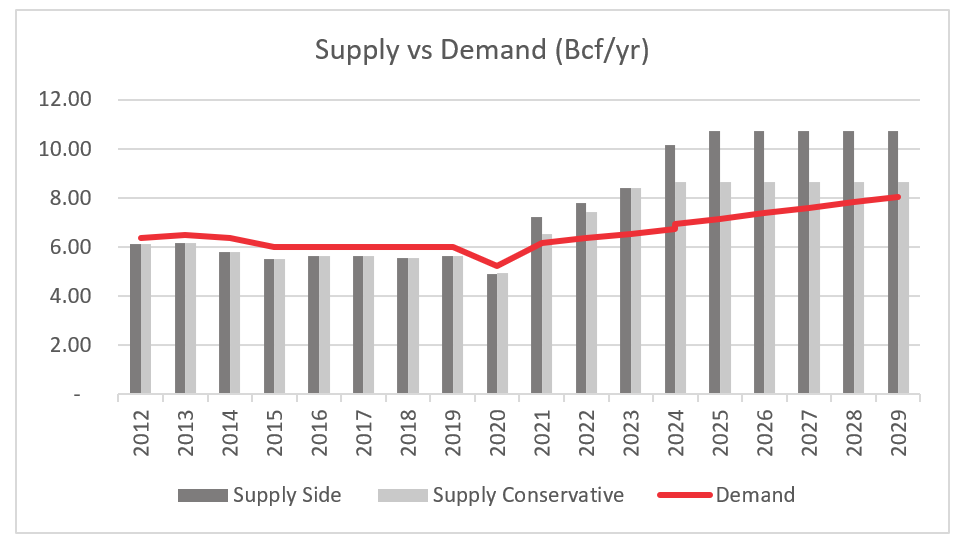

Figure 4 provides the overall estimates regarding supply vs demand each year. The dark grey bar assume production capacity is running at 100%, new projects are commissioned on time, and replacement wells are brought online to replace 100% of the production lost on ageing wells. In this case, we see supply outpace demand sometime in 2021 and continuing for the foreseeable future.

Figure 4: Supply and Demand

Taking what we consider a more reasonable view with production capacities running at less than 100% and various delays in the newer high-risk projects that are still a few years out, we see that the light grey supply bars are much more closely aligned with demand. The orange overall demand growth used in the graph is conservative at 3% CAGR – it should be noted various analysts estimate between 5-6% CAGR; however, analysts have been projecting a 5-6% CAGR since the 2000s which has yet to materialize. We think there could be a historic bias in these estimates from a “fudge factor” that analysts use regarding “new developing technologies as-yet undetermined”. That being said, there is a potential for increased demand via rockets both commercial and private, along with MRI’s, microchip and semiconductor manufacturing in Asia, and undiscovered use cases that could push CAGR above the conservative estimates used here.

Final Thoughts

There is a risk to the thesis in that helium production capacity in risky locations all comes online in their allotted timeframe and that these large new resource discoveries are proven economically viable. Even if this is the case, Imperial Helium can be profitable at helium prices below $100/Mcf and will act as a secure and stable North American provider with cheap access to the world’s largest consumer, the United States. A large potential upside Imperial Helium could see would be direct access to Japan and China, the fastest growing consumers of helium, should Canada decide to further develop its export capabilities with LNG. The company is backed by a strong management team that has met milestones ahead of schedule, brings extensive experience in drilling and completions, has partnered with experts in the helium processing space, and with the prospect of offtake agreements being signed near-term the company will be able to mitigate price risk over the next few years. We think this is a strong play into the helium market and should perform well.

—-

As always, please reach out if you have any questions.

The Intrynsyc Team

Kyle de Jong | kyle@intrynsyc.com | 604.221.9666

Gary Sidhu | gary.sidhu@intrynsyc.com | 604.682-7312 ext. 302

Kitaek Kim | kitaek@intrynsyc.com | 604.227.7346 ext. 102

Jared Fehr | jared.fehr@intrynsyc.com | 604.812.1804

Gerald Kelly| gerald.kelly@intrynsyc.com | 604.724.6335

INTRYNSYC CAPITAL CORPORATION

Oceanic Plaza

#1460-1066 W. Hastings

Vancouver, BC V6E 3X2

Canada

Disclosure

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives.

This publication is intended only to convey information. It is not to be construed as an investment guide and may be construed as an offer or solicitation of an offer to buy securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor Intrynsyc Capital Corporation can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment solely on the basis of this publication, but should first consult your investment adviser, who can assess all relevant particulars of your proposed investment. The author and Intrynsyc Capital Corporation accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.