Cu-Au: Southern BC

MC $74.7 M | S/O 44.2M | FD 51.8M | Exploration

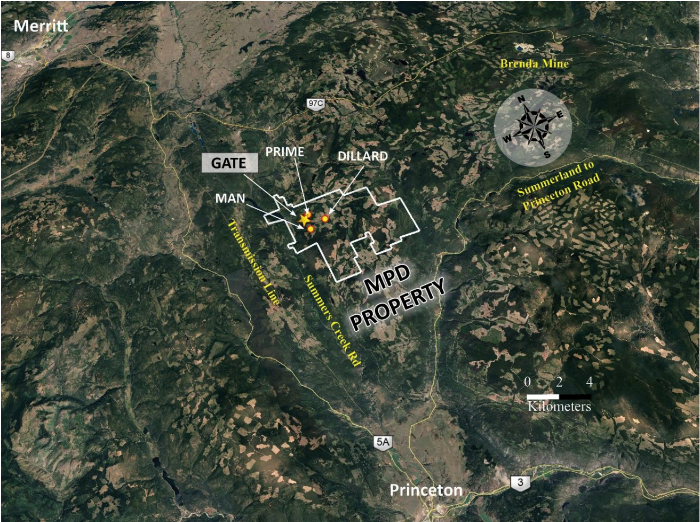

We recently attended a site visit to Kodiak Copper’s (KDK-V) 100% owned MPD property located in South-Central BC approximately 35 km south-east of Merritt, BC (Figure 1). KDK’s exploration upside is underpinned by four main targets; Gate, Prime, Man and Dillard. These targets exhibit similar characteristics as the Gate Zone which was discovered in January 2020 with hole MPD-19-003 returning 102 m of 0.53% Cu and 0.16 gpt Au.

In our opinion, KDK offers significant exploration upside as a developing porphyry copper story with three additional porphyry centres yet to be tested. Teck recently came in for a 9.9% strategic investment at an average charity flow through price of $2.82/sh (Teck’s cost at $1.95/sh) and closed on $12.7M in total. What prompted Teck’s investment was the announcement of a 282 m interval grading 0.70% Cu and 0.49 gpt Au in a 75 m step-out from the original discovery hole. With ~$15M in the treasury drilling is on-going with one drill rig on site (~5,316 m completed) and more rigs to be added in the new year.

Figure 1: Location map of MPD property 35 km south of Merritt and 25 km north of Princeton. Note location of new Gate zone discovery adjacent to Prime, and proximity of the property to major routes and transmission lines.

MPD Property Overview

The project is located 35 km south of Merritt and 25 km north Princeton with excellent access from major routes and well-maintained network of logging roads on the property itself. It took roughly three hours from Vancouver to arrive at KDK’s core logging facility along and an additional 30 mins to arrive at our first stop on the property at the Prime showing. The location, infrastructure and ease of access illustrate one of the attractive aspects of the property for majors looking for Canadian domiciled projects.

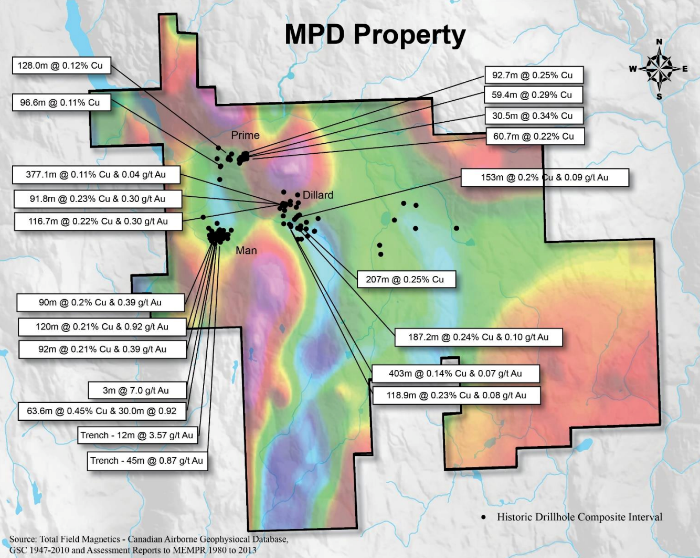

The MPD (Man, Prime, Dillard) property was consolidated by Kodiak (formerly known as Dunnedin) in late 2018. These three historic prospects have had work completed in the past consisting of 129 holes (25,780 m) between 1966 – 2014 (Figure 2). However, they were never explored as one single project nor below a vertical depth of 200-300 m. Kodiak’s initial goal based on re-interpretation of historic data and new geochemical and geophysical surveys indicated potential for higher grades at depth. This proof of concept drilling was the objective of the three-hole 2019 program aimed at getting below the historic drilling which intersected copper mineralization but at lower grades. The results of that drill program led to the discovery of the Gate Zone (MPD-19-003 returning 102 m of 0.53% Cu and 0.16 gpt Au) and spurred this follow-up drill program.

Figure 2: Historic drilling highlights showing the three main showings at the time Man, Prime, and Dillard. Previous operators include Rio-Tinto PLC and Newmont Mining Corp.

2020 Drill Program to Date and Key Take-Aways

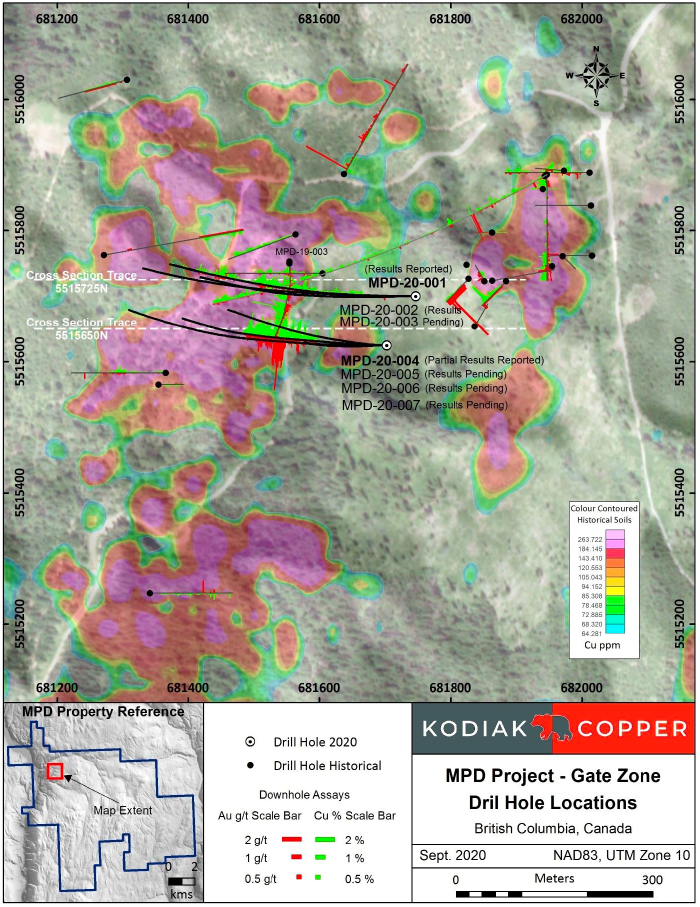

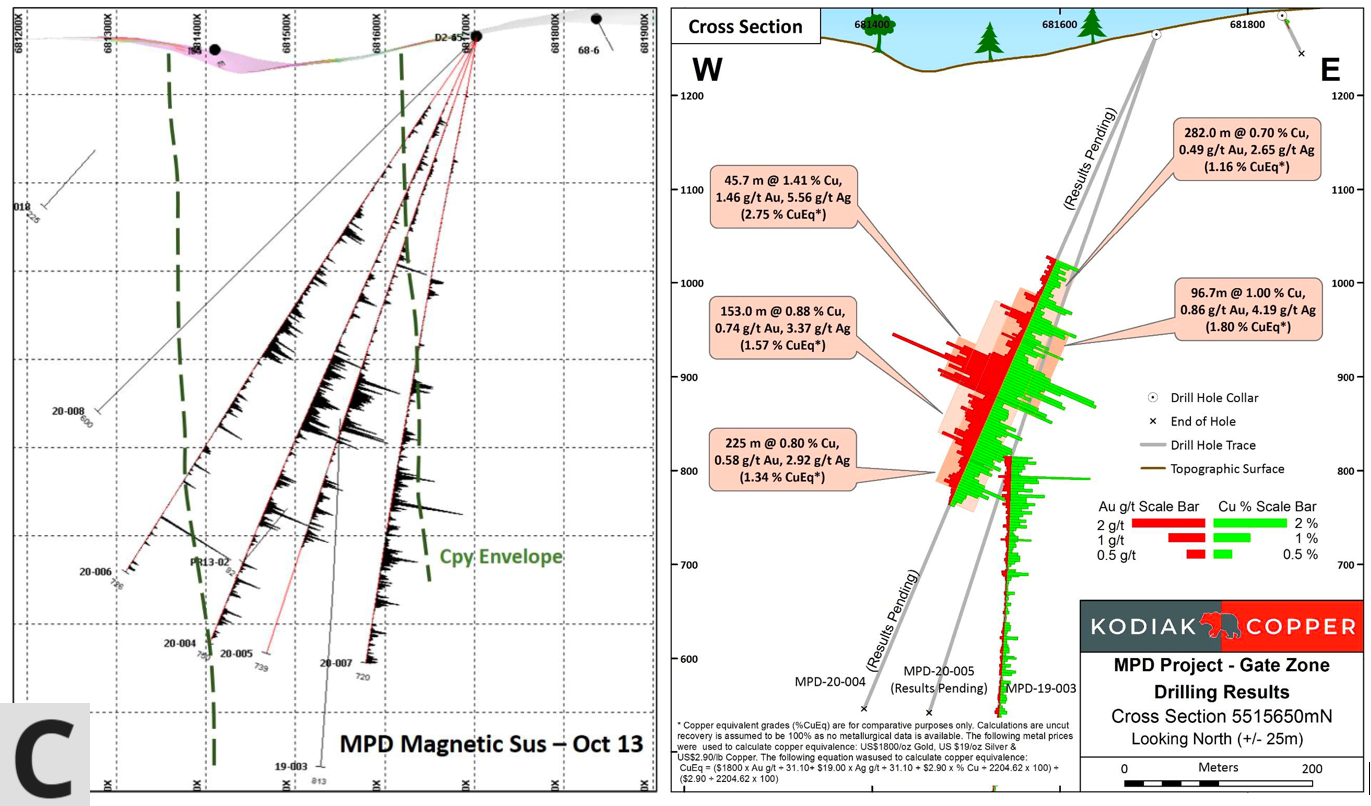

There is currently one drill rig on site with the 8th hole of this program underway and ~5,316 m completed. At the time of the site visit only partial assays had been released for hole MPD-20-004 which intersected 282 m grading 0.70% Cu and 0.49 gpt Au in a 75 m step-out from hole MPD-19-003. Shortly after the site visit the remainder of hole MPD-20-004 was released, as well as hole MPD-20-002. MPD-20-002 was drilled from the same set-up as holes 1 and 3 (assays pending) and returned similar lower grade results as hole 1 previously reported.

Figure 3: Drill hole locations of MPD-20-001 to MPD-20-008 from two separate set-ups underlain by Cu-Au soil anomalies. Note additional 500 m of Cu-Au soil anomaly to the South is yet to be tested at depth.

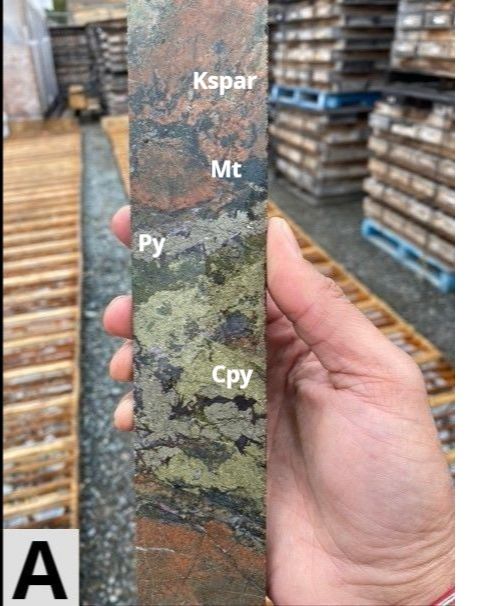

High Correlation with Magnetics: The remainder of hole MPD-20-004 was not as high grade as the upper portion of the hole. These grades were partially expected and in-line with the observations from core considering the potassic alteration carrying the high-grade mineralization wanes out in this hole after roughly 535 m. That being said, holes 5-8 are also being drilled from this set-up and we can hope to see encouraging results from the remaining holes based on the magnetic susceptibility data. A quick-log of the core identified areas of higher potassic alteration, silica flooding, and magnetite veining (figure 4 a, b) correlated well with the higher-grade intervals in MPD-20-004. Holes 5-8 have a similar magnetic signature as hole 4 and will be testing the up dip and down dip extensions. We would also like to point out that outside of the higher down-hole magnetic susceptibility readings mineralization was still present, although at slightly lower grades. This indicates that even though magnetic anomalies correlate well with high grade mineralization, we can still expect to see good grades over a broader interval than shown by the down-hole magnetics.

Drilling Down on the Controls: At the time of the site visit, MPD-20-008 had just began and was aimed at testing the up-dip extension of the mineralization. This will be the last hole from this set-up. From figure 4c we can see that the holes are closely spaced due to being drilled from the same set-up. The purpose of the holes was to determine the vertical controls on the higher-grade mineralization which is achieved by drilling up-section and down-section holes. Once the dip and plunge of the mineralization is determined through this drilling, KDK can focus on stepping out to test their geological model with greater confidence.

Next Moves: The aim moving forward will be to test the large Cu-Au soil anomaly to the south of the current drilling which strikes an additional 500 m and has not been fully tested at depth. Due to the proximity of the Gate Zone to the Prime target area, KDK could also step back to the east and drill below the Prime target where historic trench results returned 20 m of 0.89% Cu. With a target rich property and ~$15M in cash, KDK is taking a systematic scientific approach towards drill targeting which allows companies to maximize exploration dollars on multi-layered targets. With the recent release of hole 2 and the remaining assays from hole 4 we can potentially expect to see results from holes 3, 5, and 6 soon and then holes 7 and 8 late fourth quarter. Management was guiding towards adding a second drill rig in the new year at which time KDK would assess drilling the Dillard Target.

Exploration Upside: Based upon initial assessment, the deposit has similar characteristics as an Alkalic Cu-Au porphyry system (examples: Copper Mountain, Mount Polley, and Galore Creek). These deposits are characterized by magnetic highs associated with Cu-Au +/- Mo geochemical signatures typically with a higher gold credit than Calc-Alkalic porphyries (Highland Valley, Red Chris, and Kemess). What is also important to know is that Alkalic porphyry deposits typically occur in clusters which is what we may have here at the MPD property with additional untested porphyry centres at Man, Prime and Dillard (figure 1). At each of these target areas, oxidized copper mineralization comes right to surface and appears to be associated with narrow quartz-chalcopyrite veins as seen in the core. The Man target trench results returned 46 m of 0.89% Cu while Dillard appears to have similar characteristics as the Gate Zone based on historic drill core.

Figure 4:

A) Demonstrates the correlation with increasing potassic alteration (Kspar) and copper mineralization (Cpy) and magnetite (Mt).

B) Despite the lack of obvious potassic alteration we do see some on a localized scale, but we notice a definite increase in narrow quartz-cpy +/- mt stockwork veins. This interval from 397.4 m to ~401.7 m grades over 1% Cu.

C) The cross section on the left shows the recorded down hole magnetic susceptibility of each hole core logged which can roughly be compared to the grade seen in hole MPD-20-004. Note, magnetic susceptibility is just one aspect associated with copper mineralization and we would like to point out that areas outside of increasing magnetic amplitude also carry good copper grades.

Kodiak Copper Corp. Site Visit Summary

KDK has successfully demonstrated their proof of concept drilling and has now shifted to continued discovery and growth as the team refines the geological model with current drilling. We anticipate ongoing news flow from the drill bit as KDK continues to step further south to test the coincident magnetics and geochemical anomaly that stretches at 500 km along strike and up to 300 m wide.

Although the system hasn’t been fully defined as a Calc-Alkalic Cu-Au porphyry deposit yet, initial characteristics point towards that deposit model type. As mentioned, these systems are known to have multiple porphyry centres which would align with the anomalies that we are seeing on the property signaling the potential for a cluster of porphyry deposits never tested at depth.

Assays are pending for five more holes, and we believe KDK is poised to build value via the drill bit at the Gate Zone, and also in the New Year at the many other targets on the property.

—-

As always, please reach out if you have any questions.

The Intrynsyc Team

Kyle de Jong | kyle@intrynsyc.com | 604.221.9666

Gary Sidhu | gary.sidhu@intrynsyc.com | 604.682-7312 ext. 302

Kitaek Kim | kitaek@intrynsyc.com | 604.227.7346 ext. 102

INTRYNSYC CAPITAL CORPORATION

HSBC Building

#1320 – 885 West Georgia St.

Vancouver, BC

V6C 3E8

Canada

www.intrynsyc.com

The information contained in this message is confidential and is intended solely for the addressee(s) only. Please be advised that any review, dissemination, copying, distribution or other use of the contents of this message is strictly prohibited. Intrynsyc Capital will not be liable for direct, special, indirect or consequential damages arising from alteration of the contents of this message by a third party. If you have received this communication in error, please notify the sender immediately by return e-mail to info@intrynsyc.com or via telephone at +1.604.221.9666 and delete this message and all attachments from your system.

Disclosure

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives.

This publication is intended only to convey information. It is not to be construed as an investment guide and may be construed as an offer or solicitation of an offer to buy securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor Intrynsyc Capital Corporation can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment solely on the basis of this publication, but should first consult your investment adviser, who can assess all relevant particulars of your proposed investment. The author and Intrynsyc Capital Corporation accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.