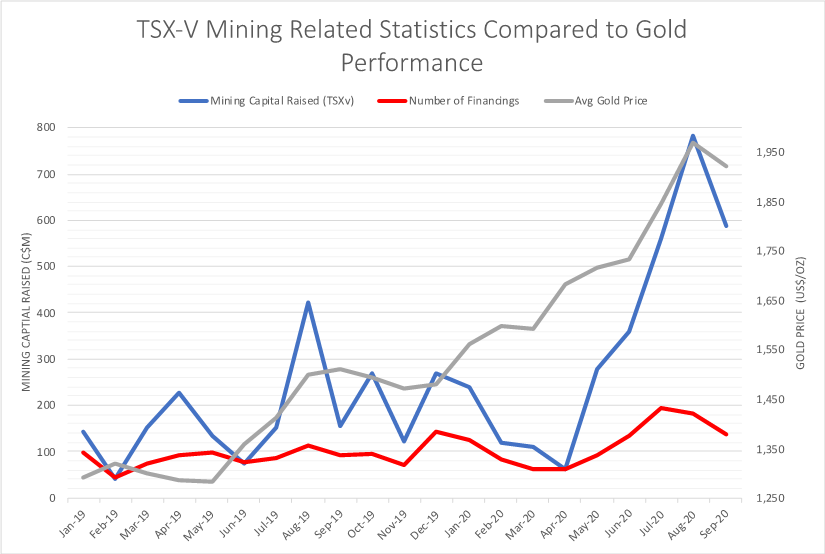

Despite showing signs of deal fatigue towards its tail end, the junior mining sector in Q320 exhibited very much a continuation of the momentum we saw drive the market in Q220. The figure below demonstrates the steep increase in mining capital raised through Q320, with total financings posting 7% higher than the previous quarter. Within the span of H120, ~$1,168M in equity capital was raised across the TSXV’s mining sector in contrast with the $1,931M raised in Q320 alone, demonstrating the disproportionate investor interest this past quarter relative to the year as gold and copper reached YTD highs.

Fig. 1 TSX-V Mining Sector: Capital Raised against Number of Financings against Spot Gold YTD

Despite the outperformance in precious metals, some of the best performers in our mining portfolio were base metals companies such as Kodiak Copper Corp. (KDK-V) and Pan Global Resources (PGZ-V): two companies focused on creating value through discovery via the drill bit.

Kodiak Copper Corp (KDK-V):

Kodiak Copper reported a significant drill hole during the quarter intersecting 282 m grading 0.70% Cu and 0.49 gpt Au in a 75 m step-out from the original discovery hole announced in January of 2020. This recent success and the developing potential for multiple porphyry centres on this property prompted Teck Resources to come in for a 9.9% strategic investment. With a target rich property and ~$15M in cash, KDK is taking a systematic scientific approach towards drill targeting which allows companies to maximize exploration dollars on multi-layered targets. Assays released last week were lower grade compared to the high-grade core of MPD-20-004 causing a bit of weakness in the stock. However, we believe the pending assays for the five additional holes will build upon the higher-grade core discovered in hole 4 allowing KDK to better refine their targeting and follow it to the south along strike. Additional exploration (slated for the new year) will be aimed at testing the numerous high-grade copper showings on the property such as at the Man target trench which returned 46 m of 0.89% Cu. We believe the oxide mineralization in these trenches is in-situ mineralization related to the deeper sulphide mineralization seen in core samples indicating the unrealized potential at depth similar to the Gate Zone discovery. We are eagerly awaiting drill results and next moves.

Link to our Kodiak Copper site visit report here.

Pan Global Resources (PGZ-V):

Another one of our top performers was Pan Global Resources, up ~80% for the quarter. PGZ is focused on copper exploration in Spain exploring for volcanogenic massive sulphide deposits (VMS). VMS deposits are unique in the fact that they are polymetallic, containing multiple minerals (Cu, Au, Zn, Pb), and pack a lot of metal in a small area minimizing the mining footprint. Current drilling has identified two separate mineralized horizons (upper and lower conductor plates) with the potential for additional stacked lenses, a feature not uncommon to VMS deposits. Drill results are imminent and will further help decode the size of the current system which has currently been defined over a strike of length of 600 m. Drilling is focused on expanding the footprint of mineralization over an additional 4 km of untested ground.

Link to our most recent PGZ note here.

Looking Ahead into Q420

Though we are wary of making market projections just ahead of US election results, we believe that the monetary stimulus paradigm is here to stay in the absence of a vaccine. We expect further stimulus to provide tailwinds for assets in general, though not without intermittent choppiness as the market reacts to news-flow. We have been and continue to be partial to copper above other metals because of its long-term favourable fundamentals i.e. rising demand with falling supply (a recap of our copper thesis here). We are currently working on multiple ESG deals as part of our diversified portfolio that we intend on sharing with our investors soon. Ahead of a noisy quarter, we expect to defer to our fundamentals oriented approach and continue to bring valuable deals to our clients.

—-

As always, please reach out if you have any questions.

The Intrynsyc Team

Kyle de Jong | kyle@intrynsyc.com | 604.221.9666

Gary Sidhu | gary.sidhu@intrynsyc.com | 604.682-7312 ext. 302

Kitaek Kim | kitaek@intrynsyc.com | 604.227.7346 ext. 102

INTRYNSYC CAPITAL CORPORATION

HSBC Building

#1320 – 885 West Georgia St.

Vancouver, BC

V6C 3E8

Canada

www.intrynsyc.com

The information contained in this message is confidential and is intended solely for the addressee(s) only. Please be advised that any review, dissemination, copying, distribution or other use of the contents of this message is strictly prohibited. Intrynsyc Capital will not be liable for direct, special, indirect or consequential damages arising from alteration of the contents of this message by a third party. If you have received this communication in error, please notify the sender immediately by return e-mail to info@intrynsyc.com or via telephone at +1.604.221.9666 and delete this message and all attachments from your system.

Disclosure

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives.

This publication is intended only to convey information. It is not to be construed as an investment guide and may be construed as an offer or solicitation of an offer to buy securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor Intrynsyc Capital Corporation can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment solely on the basis of this publication, but should first consult your investment adviser, who can assess all relevant particulars of your proposed investment. The author and Intrynsyc Capital Corporation accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.