Key Takeaways

- Lithium Demand will triple by 2035 – current projects produce significant GHG’s and rely heavily on China for refining.

- Brine technologies require an incredible amount of water to be processed – the lowest cost operator has a significant advantage and ideally leverages existing infrastructure.

- Greenfield Li extraction projects in North America have huge scalability risks due to the low lithium concentrations and must keep opex costs as low as possible to be economically viable.

- Volt Lithium’s DLE technology offers unmatched scalability, making it the ideal choice for O&G operators seeking ESG investments. With best-in-class recovery rates at concentrations as low as 34 parts per million, coupled with the industry’s lowest operating costs, Volt stand as the optimal solution for North American lithium extraction.

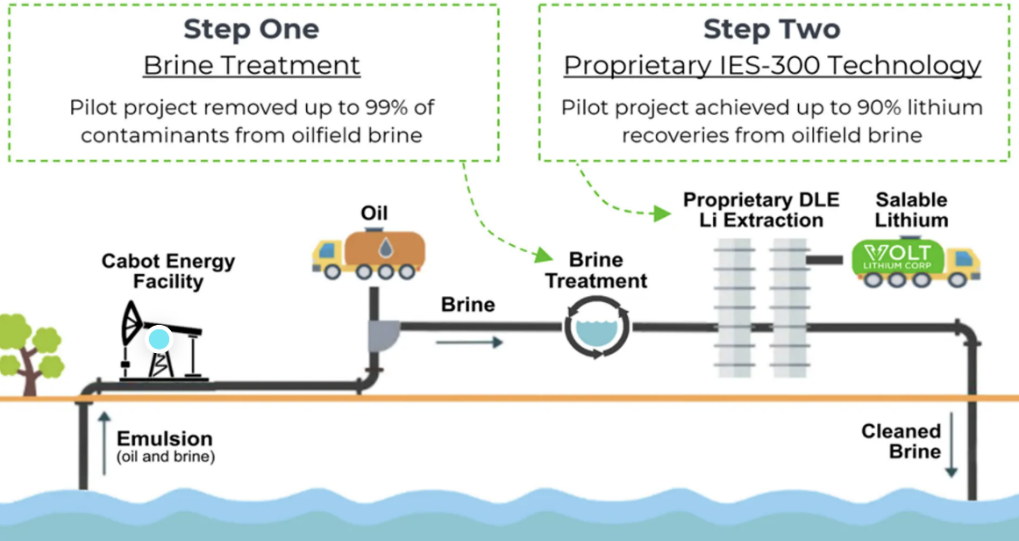

Volt Lithium (VLT:TSXv), a Canadian technology company, has developed a novel Direct Lithium Extraction (DLE) technology tailored for the oil and gas industry. Volt is able to take produced water from the wellhead, remove various inorganics, and recover 95%+ of the available lithium via their unique sorbent, allowing the lithium to undergo further refinement into high-quality lithium carbonate or hydroxide.

Volt stands out as an industry leader, offering best-in-class technology along with the lowest operating costs among its peers. These distinctive qualities position Volt as the preferred choice for oil and gas producers and water treatment companies seeking a further revenue stream, operational savings and ESG solutions.

Lithium Background

Lithium is widely recognized for its critical role in reaching carbon-emission reduction targets set by various nations across the globe. Among its various forms, lithium carbonate stands out as the foremost precursor for lithium-ion batteries, which power everything from small devices to electric vehicles (EV batteries being as much as 7% Li). Lithium hydroxide, an upgraded form of lithium carbonate, primarily is used in high-nickel compositions like nickel manganese cobalt (NMC) batteries.

The demand for lithium is expected to double by 2030 and triple by 2035. However, the forecasted trajectory of lithium’s demand growth is not without its uncertainties. A significant factor influencing demand is the electric vehicle market, which currently absorbs approximately 74% of all lithium production. If consumers opt against purchasing EV’s, or governments retract incentives for EV adoption, or in the event of a breakthrough in alternative energy sources, the anticipated growth in lithium demand could decelerate. An interesting development is the nascent technology of salt (Na) batteries, pioneered by companies like CATL. These batteries offer sustainability by replacing lithium with salt, and eliminating the need for cobalt, copper, or nickel. However, they currently exhibit lower energy densities and shorter lifespans compared to their lithium-ion counterparts. Despite their limitations, their significantly lower cost could position them as a serious contender in the large infrastructure energy storage space.

Australia, Chile, China, Argentina, and Brazil stand as the predominant players in global lithium production. Notably, 60% of the world’s battery-grade lithium undergoes refining in China. For North America, the pursuit of local lithium production and refining holds paramount importance in fulfilling its electrification objectives in a socially, environmentally and geopolitically responsible manner.

Lithium Extraction Technologies

Two primary methods dominate lithium production: evaporation ponds and mining, with a promising third option emerging in the form of DLE technology.

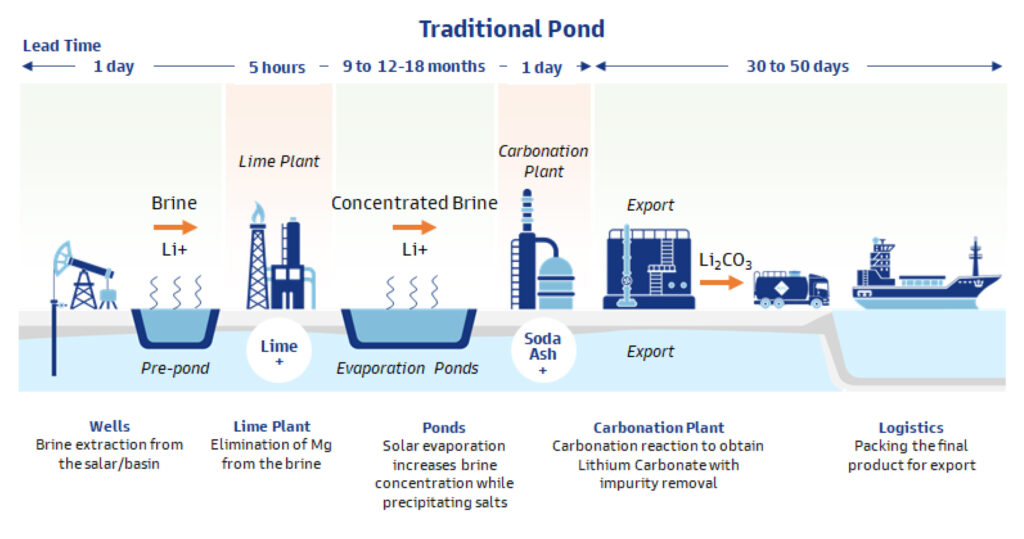

In South America, solar evaporation ponds are a prevalent but water-intensive approach, consuming substantial volumes of water (1,500lbs of water per pound of lithium). Despite only recovering 50% of the lithium, brine ponds remain economical due to their concentrations exceeding 1000 parts per million (ppm) of Lithium, compensating for the low recovery rates. Additionally, operational costs remain relatively low due to the passive nature of solar evaporation, which can take up to a year to leave behind a residue of assorted salts.

Nevertheless, brine pond operators are seeking alternatives that will reduce their water usage and enhance lithium recovery rates, with DLE technology emerging as a strong front-runner.

Open-pit mining is the primary extraction method used in Australia, which entails blasting the rock before hauling it away for subsequent processing of crushing, grinding, roasting, and cooling to produce a concentrate known as spodumene (~6% lithium content). Currently, Spodumene is then transported to China for further refinement into lithium carbonate or hydroxide. While operational costs are in line with standard mining practices, it uses a substantial amount of energy for heating, consumes vast quantities of fresh water, and produces the most greenhouse gases out of any form of lithium recovery.

The economics of extracting lithium in North America have historically been quite weak. Compared to the naturally occurring resources found in Australia, Chile, and Brazil, lithium concentrations in North America are so low that traditional extraction methods would render projects economically unfeasible in comparison. Especially when considering the feasibility of lithium production from brines.

Direct Lithium Extraction (DLE) is the cutting-edge technology that could position North America as a significant producer of lithium. Companies such as Compass Minerals, E3 Lithium, Lithium Bank, and Standard Lithium are spearheading feasibility and pilot projects to develop large pumped brine lithium extraction facilities.

DLE typically consists of four phases –

- Initial processing – pre-treating the brine feedstock to remove solids or chemicals,

- Separation – brine is passed through a sorbent/solvent, typically in pressure vessels or vertically integrated exchangers, such as an ion exchange

- Extraction – an acid wash is used to release the lithium in the form of LiCl

- Refinement – using sodium carbonate (lye) the LiCl is transformed into lithium carbonate which can be sold for use in batteries, and / or be upgraded into lithium hydroxide.

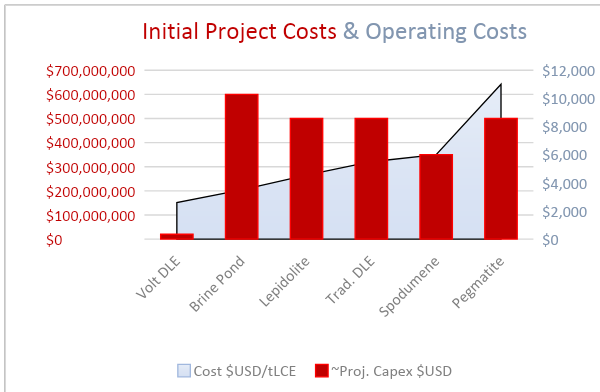

Figure 2 illustrates the estimated operating costs and initial project capital expenditures (capex) associated with various lithium extraction methods, including brine ponds, open-pit mines (for lepidolite, spodumene, and pegmatite) as well as DLE. Brine ponds and open-pit mines demand substantial investments in operations and upfront capital. For traditional DLE projects, represented here by E3 Lithium, Lithium Bank, and Grounded Lithium, similar capital invasiveness is observed.

While Volt’s DLE isn’t a direct apples-to-apples comparison in terms of the project scope, it is worth noting the value proposition Volt’s offering in terms of low initial capital expenditure while unlocking lithium from locations that would typically be deemed uneconomical.

DLE Growing Pains

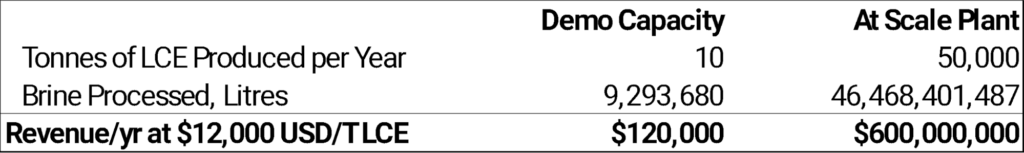

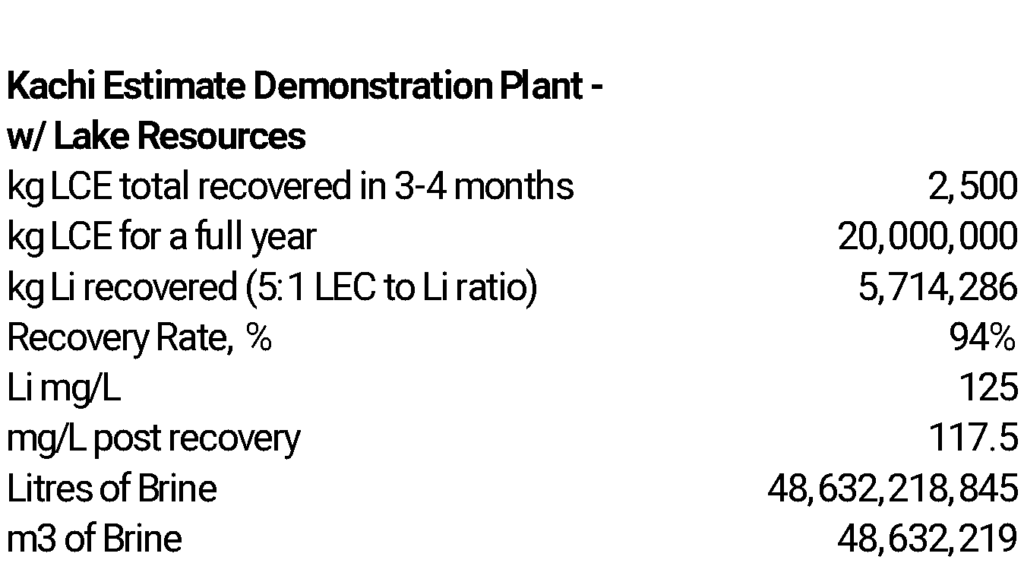

Current DLE technology faces certain constraints that must be addressed to achieve profitability. Specifically, pumping and processing very large volumes of water due to the lower lithium concentrations. For instance, Lilac unveiled figures regarding their Kaichi demonstration plant, which is slated to be shipped to an Argentina brine pond. The economics are outlined below: (Note: various assumptions have been made based on Lilac News releases):

The crux of the matter is the scalability challenge faced by the Kachi demo plant. While its success is evident, the scaled-up version will need to process approximately 5000 times more brine – an amount roughly equivalent to half of all the produced water generated by the Bakken each year. The sheer volume of brine will require substantial infrastructure, energy, and of course have inherent scaling risks compared to the demo phase.

Amid these considerations, it’s worth noting that Lilac’s partnership is squarely focused on Argentina’s brine ponds. This context is an optimal scenario for implementing DLE technology, given that brine bonds already have infrastructure to move large volumes of water with exceptionally high Lithium concentrations.

The challenges Lilac faces are not unique. Consider, for instance, a Canadian greenfield project aiming to produce 20,000 tonnes per year of lithium hydroxide. This project will see an average lithium concentration of 74.5 milligrams per liter (mg/L) and will need to process a staggering 47 billion liters of water annually – a scale comparable to that of the Lilac brine pond, however, this project won’t have the leverage of Argentinian brine pond infrastructure or their significantly higher lithium concentrations.

Transporting large volumes of water consumes significant energy. Projects dedicated solely to brine extraction, such as those pursued by Lithium Bank and E3, will necessitate new wells and powerful pumps to displace the brine from their reservoirs and all associated infrastructure with developing a new production field. In terms of economic feasibility, targeting the lowest capital and operational costs possible is really the only way to pursue a greenfield location in North America.

Volt Lithium

The optimal configuration for DLE prioritizes three key types of locations: oil and gas projects in production (produced water treatment facilities), geothermal wells, and South American brine ponds.

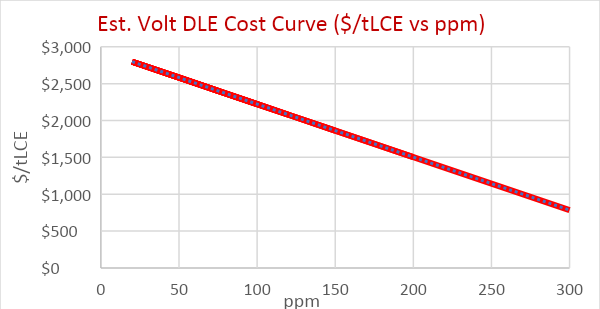

Volt Lithium has developed a proprietary DLE process that pre-treats the brine using off-the-shelf equipment that is then passed through their DLE titanium oxide sorbent, a technology not unique in itself but distinguished by Volt’s nanotechnology research in developing a 3D spinal structure that optimizes absorptivity. Volt’s process streamlines washing, stripping, and the cycling process such that they’ve reduced their operating costs at their pilot plant from US$8,000 per tonne of lithium carbonate equivalent (tLCE) to US$2,800/tLCE, with further reductions anticipated.

In contrast, most DLE operators incur running costs within the range of US$3,500 – US$5,000/tLCE, rendering them 25-50% more expensive than Volt’s operation. Moreover, other DLE technologies require higher concentrations (>100mg/L) to function. Volt stands out as the sole operator achieving 90%+ recovery in sub 40ppm concentrations.

Volt has a permanent demonstration plant in Calgary that has been used and is in continuous operation to process real-world brine from basins across North America and improve their sorbent technology. They have released a PEA for their Rainbow Lake project and recently secured a significant strategic investment of US$1.5M from a prominent player in the Delaware Basin to fund a commercial field unit that will produce battery grade lithium hydroxide. These strategic partnerships and investments act as irrefutable validation of Volt’s innovative technology and huge potential to influence North American lithium production.

At the helm of Volt is Alex Wylie, serving as President and CEO, having founded the company in 2021. The team he’s formed includes 5 PhD’s based out of their University of Alberta lab at the Nanotechnology Research Center, where they developed their titanium-oxide IP. Prior to Volt, Alex has had a long career in startups mainly in the oil and gas sector. Some of those roles include CEO of Bruin Oil and Gas (acquired by Enerplus for $465m) and CFO of Renegade Petroleum, which peaked at ~10,000 boe/d and nearly a $1B market cap. Alex has a strong background in startup ventures and extensive experience in the oil and gas sector, all of which positions Volt for a successful transition from R&D to commercialization.

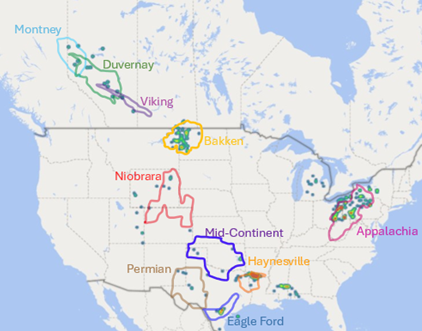

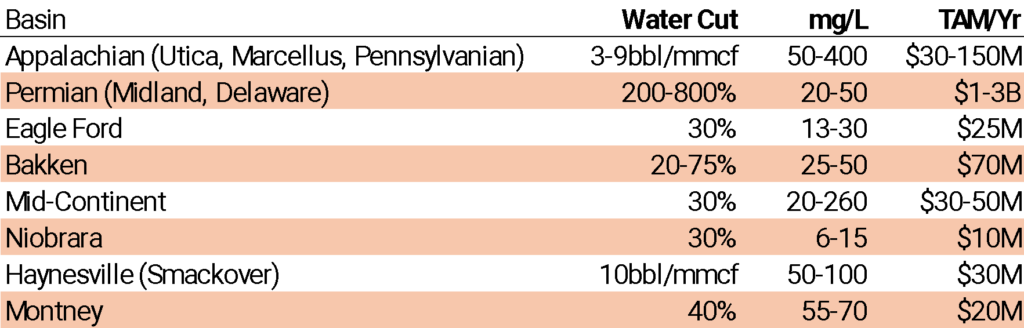

Volt’s TAM

Volt’s impressive recovery rates and class leading operating costs unlocks opportunities that were previously deemed uneconomical. The below figure illustrates the estimated total addressable market (TAM) across various US basins, showcasing the potential for DLE bolt-on technology in North America:

The TAM estimation involved several assumptions and was derived from various sources, predominantly the U.S. Geological Survey National Produced Waters Geochemical Database. While acknowledging these assumptions, this analysis provides insights into the potential opportunities, particularly highlighting the Permian Basin as a prime candidate due to its significant water cut and immense production rates. Operators in the Permian face persistent pressure to enhance their water resource management capabilities, given the substantial volume of wastewater they generate at ~15-20 million barrels per day.

ESG considerations loom large for emerging technologies, and Volt’s is no exception. While somewhat counterintuitive, Volt’s technology contributes to improving the profitability of oil and gas wells by capitalizing on the brine extracted during regular operations. Additionally, Volt’s DLE-treated water meets frac specifications, enabling its recycling and thereby prolonging the well’s lifespan (reducing costs) while reducing freshwater consumption – addressing a critical need in various U.S. basins.

The comparative impact of DLE technology is also noteworthy, hard rock extraction, for instance, emits roughly 47 times more equivalent tons of carbon dioxide (tCO2eq) than extracting lithium from brines.

Volt’s Economic Proposal

When evaluating the oil and gas landscape in relation to Volt’s DLE technology, it’s essential to consider the costs associated with produced water disposal across Canada and the U.S. In major basins, these costs typically range from US$1 to $5 per barrel, contingent upon factors such as the disposal method, required treatment before disposal, and transportation distance.

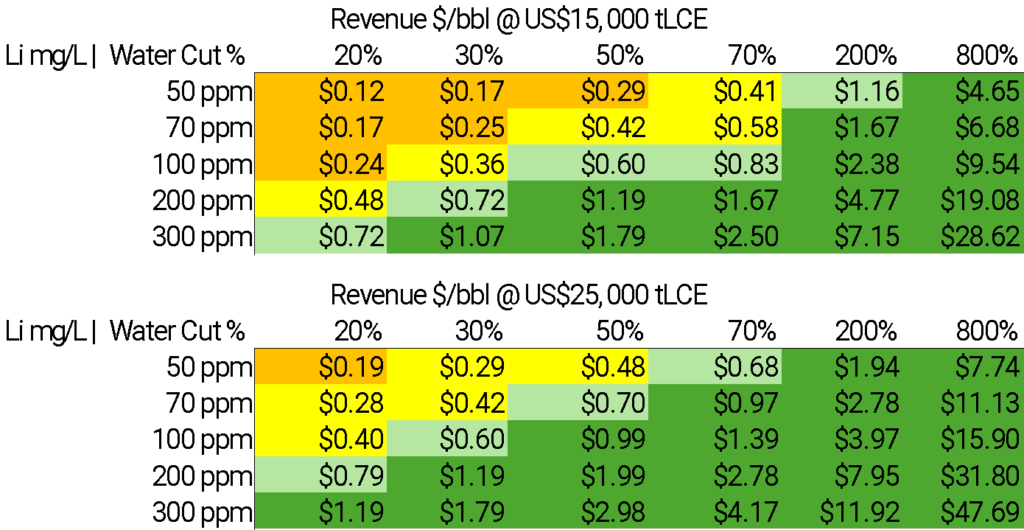

The adjacent tables provide insight into Volt’s revenue per barrel of oil across a spectrum of water cuts (ranging from 20% – 800%) and concentrations (from 50ppm to 300ppm). This analysis illuminates the DLE sweet spot, characterized by higher concentrations and water cut percentages, which particularly aligns with the Permian, Bakken, and potentially the Haynesville and Appalachian basins.

Notably, a higher water cut amplifies the impact of lithium recovery for oil and gas operators, leveraging the value proposition in high water-cut locations.

For instance, consider an operator in the Permain with a 500% water cut. If their water disposal costs were to increase by $1/bbl, their operating netback would decrease by $5/bbl – a substantial 5x impact. This also applies to recovered costs through lithium extraction, saving $1/bbl in disposal costs (or recovered costs via lithium) would increase operating netbacks by $5/bbl; the higher the water cut, the greater the leverage of returns to the operating netback. Volt’s DLE treated water also becomes frac spec, so it can be recycled and further extend the life of the well.

Conclusion

Volt’s DLE technology stands out as a leader in extraction, boasting best in class at sub 50ppm Lithium concentrations while maintaining the lowest operating costs. Their DLE “sweet spot” coincides with the Permian Basin, a region grappling with significant water consumption issues. Here, any additional revenue generated from produced water will significantly leverage operating netbacks due to the high water-oil ratio prevalent throughout the basin. Not surprisingly, Volt’s first strategic partner is an operator in the Permian.

By monetizing brines that were previously uneconomical, Volt taps into a conservative TAM exceeding $3 billion of annual revenue just in North America with no validated competition that we can find. The benefits are not solely financial, as Volt’s technology will assist oil and gas operators in meeting Environmental, Social, and Governance initiatives. Such investments provide positive impacts on the company, local aquifers, and will facilitate the production of lithium chemicals for the low-emission vehicle battery market.

If Volt’s technology performs on-site and at scale as effectively as it does in their current permanent demonstration facility, which they will attempt to demonstrate at their strategic location in the Delaware Basin, Volt could also disrupt the long-term profitability of planned greenfield projects (brine and hard rock) globally. This scenario alone may justify considering Volt as a soft-hedge against such projects.

Disclaimer

Intrynsyc and its employees are minority shareholders of Volt. Intrynsyc has acted as advisor and finder for Volt in the past 2 years. Details available upon request.