Big Changes Come in Small Sizes – Compostable Single-Serve Coffee

Company Overview

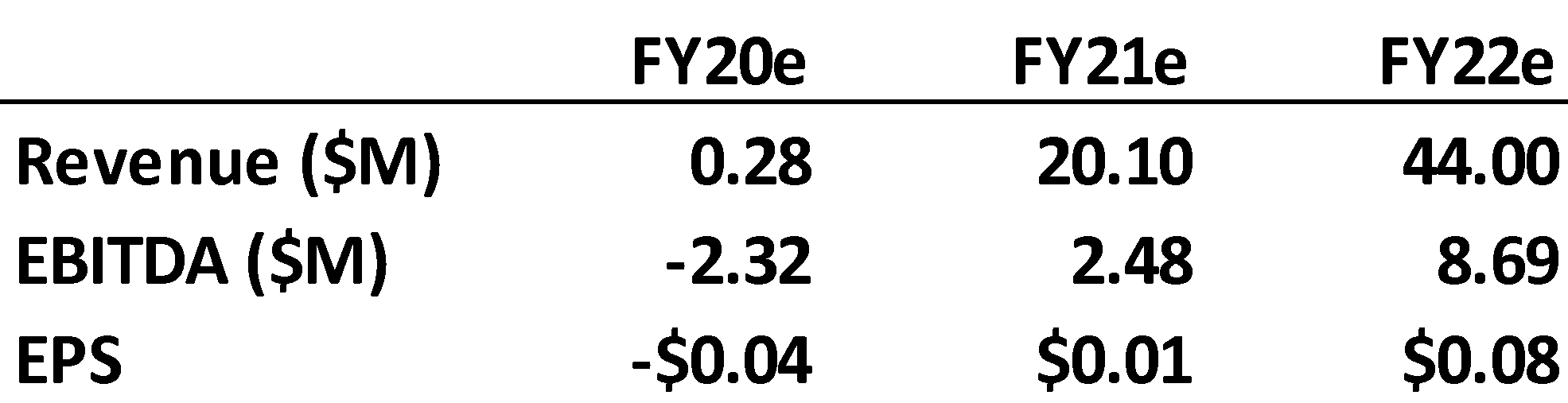

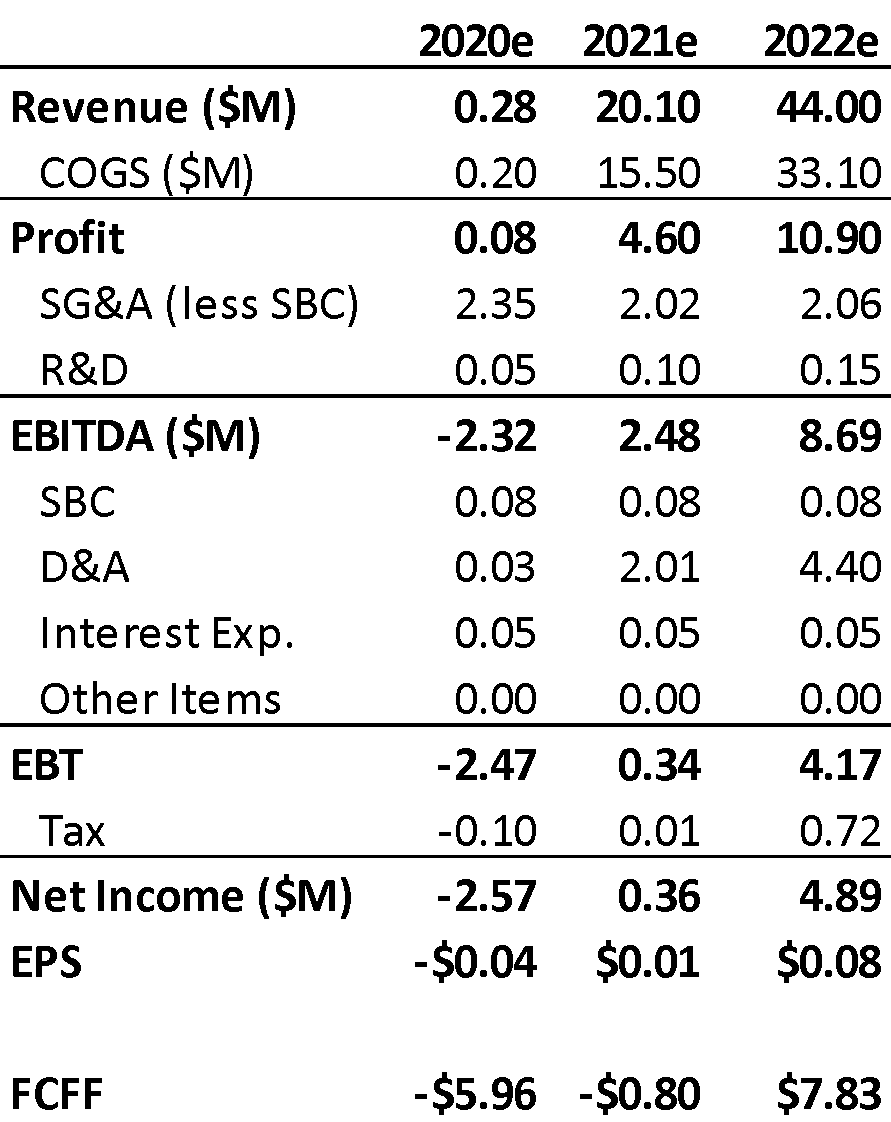

NEXE Innovations is a cutting-edge developer of plant-based materials focused on replacing plastics with entirely compostable components. Initially targeting the single-use coffee market, NEXE has patented and manufactured 100% compostable products as quality alternatives to Keurig brewing systems K-Cups and Nestle’s Nespresso pods. With an addressable market estimated at US$19 billion in 2020, NEXE is forecasting their single-serve coffee segment will grow from under $500k in 2020 to $20 million in 2021 as they ramp up existing production lanes and take delivery of additional lanes delayed due to COVID-19. As the company grows, NEXE plans to leverage their materials expertise and IP to enter markets beyond of single-serve coffee. The company plans to announce an IPO in Q4 2020.

Key Takeaways

- Growth for single-serve consumables is estimated at 7% CAGR through 2024, with 40 to 50 billion single-serve cups to be sold in 2020.

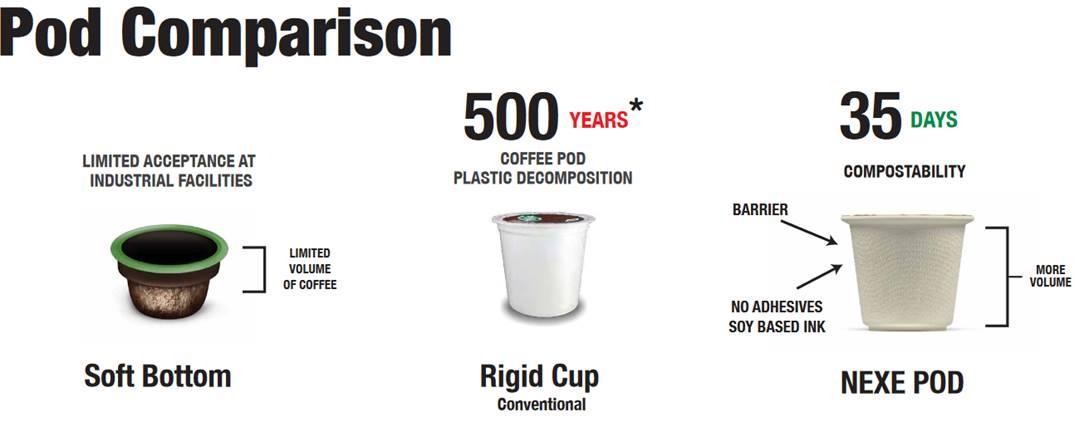

- NEXE will be the sole north American patent holder of 100% compostable K-Cups and Nespresso pods that provide the same look and quality as the original designs, unlike current market compostable cups using “mesh” shell designs that provide less than ideal storage and brewing conditions for the grounds.

- Less than 25% of all single-serve coffees will be recycled. As investors focus on sustainability and ESG investments grows, tackling recycling and “cradle-to-cradle” product lifecycles will become more important. Keurig and Nespresso already deal with major backlash for both lack of recyclability and the complexity of the recycle process.

- COVID-19 has hurt smaller independent coffee distributors who typically sell in brick and mortar locations.These smaller distributors consider sustainability a core goal of their operations, and NEXE will provide them with alternative sources of revenue via single-serve consumables that remain in-line with their investment in sustainability.

- Leveraging their current knowledge and that of key stakeholders, develop a suite of plant-based materials IP for growth into the broader single-use plastics market, effectively doubling the TAM.

Conclusion

We think NEXE’s timing for entry into the single-serve cup market is perfect. The catalysts via work-from-home and self-isolation is increasing consumption, investors are increasingly ESG focused, and the limited options consumers have for quality compostable cups make NEXE ideally positioned to take advantage of said tailwinds.

Deeper Dive – Company and Market Analysis

Company Snapshot

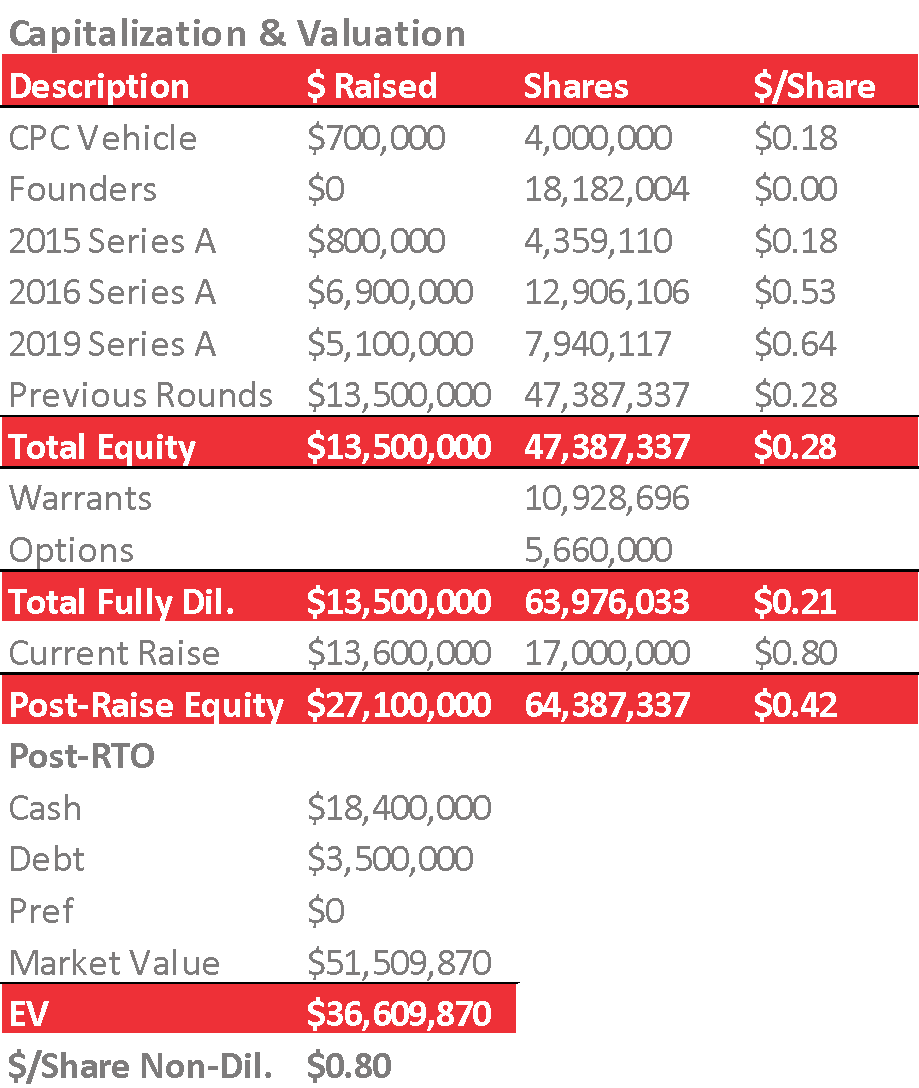

Co-founded by Darren Footz (previously President of Granville Island Coffee) and Ash Guglani (Investment Banking) in 2014, NEXE’s management team brings deep expertise in coffee roasting, packing, and distribution, forming the backbone needed to support their patented innovative technology. Management retains ownership of about 35% of the company, and the three previous raises from 2016 to 2019 have all been at increasing prices providing further confirmation on the progress the company has made since inception.

The company’s balance sheet remains clean of substantial encumberment, as the previous financings and government grants have covered operating expenses to date. The only debt on the books currently is government debt. To fund the working capital and capex required for expansion in 2021 NEXE is raising $13.6M at $0.80/share, oversubscribed from the original $5M, giving the company a pre-money of $51M prior to IPO.

Valuation

Given the inherent risks in a start-up and using a weighted DCF and Multiples method we net an intrinsic value of $0.93 /share on a non-diluted basis post-raise. Due to the nature of the business and segment growth, we feel the aggressive growth being forecast is reasonably attainable and worth the 5x 2022 EBITDA valuation and 10% DCF terminal growth with a high bar ROE of 15%. Valuing early stage companies is highly speculative, and our estimates are not intended to be used as the sole basis for investing.

The Market & Its Waste Problem

At the beginning of 2019 almost 41% of Americans owned a single-serve coffee brewing machine, and sales of single-serve cups had gone from 2.3 billion in 2010 to 10 billion in 2019 for Keurig alone, a 17% compounded annual growth rate. Considering Keurig has about a 20% market share, we estimate 40 to 50 billion single-serve cups will be sold in 2020 with a total addressable market to manufacturers and distributors of around US$18-20 billion. Additionally, the catalysts for growth in the single-serve cup market have never been stronger as people work more from home and self-isolate, integrating single-serve coffees into their daily routine in lieu of traditional alternatives like coffee shops.

“From a personal standpoint, it saves 20 seconds of your day,” he says. “What’s that worth?” – John Sylvan, inventor of K-Cups regarding the environmental damage they’ve caused.

In 2018 the world collectively threw away around 56 billion single-serve cups into landfills, an equivalent of 896,000 tonnes or 3% of the total food waste the US generates annually. Consumers are becoming exceedingly aware of the negative environmental impact their coffee choices have. Interestingly, most understand the negative impacts but don’t change their behaviors; we theorize this is due to lack of quality sustainable alternatives to existing single-serve cups. Those who do attempt to dispose of traditional single-serve cups properly, as they are advertised as recyclable, are faced with challenges making the experience anything but convenient.

This issue is made apparent by a recent class-action lawsuit in July 2019 that shows manufacturers definition of “recyclable” can vary from what an individual, or the law, might reasonably assume. For example, only certain parts of a Keurig cup are recyclable, so you’ll need to separate each part before properly disposing of them. For Nespresso, you need to use their included red disposal bags and drop your pods off at certain Nespresso locations so they can take them to their custom recycling facility to process. These barriers to recycling are relegated to consumers who usually end up throwing the single-serve cups into the garbage.

The waste described above is not unique to the coffee world. The increase in demand for small and convenient packages with quality designs and unique visuals is expected to drive the total addressable market of single-use packages from US$34 billion to US$47 billion by 2025. This is a substantial amount of product that consumers will want to be more sustainable and compostable, and NEXE plans on being part of the solution by growing beyond single-serve coffee.

The Solution

In an 11,000 sq. Ft facility in Surrey, BC, NEXE Innovations can receive, roast, pack and ship up to 20 million units of K-Cups and has ordered an additional five “lanes” from Italy that will increase production capabilities to around 120 million pods in 2021. Generating this amount of sustainable, 100% compostable single-serve cups is no small engineering feat. Using patented materials and assembly techniques, NEXE creates an outer fibrous shell (made of various sustainable plants that aren’t sources of food) that is bonded via ultrasonic welding to an inner PLA (polylactic acid) shell made from corn husks and leftover sugarcane stalks. On an individual basis each component isn’t overly difficult to produce, but it becomes significantly more so when designing for harsh environments like a brewing machine. Most fibrous biodegradable materials breakdown in 90°C water, so NEXE uses the PLA inner shell to both protect the outer shell from water and lockout air to keep the coffee grounds fresh with a 12-month shelf life. PLA is delicate, so a fibrous external shell provides the structural integrity to withstand both exposure to the elements and the high pressures inside the brewing machine used to move water. NEXE’s patented design avoids the use of glues to bind components and plastics for assembly, helping to distinguish themselves from their competitors as glues are tougher to apply consistently during manufacturing, can contain VOC’s, or otherwise degrade due to high temperatures during brewing.

NEXE’s patented designs and manufacturing techniques provides an intellectual moat that will keep competitors from developing products of similar quality at scale for a few years. This moat is bolstered by the largest players, Nespresso and Keurig, focusing on recyclability instead of compostability due to the use of aluminum and plastics in their design.

Importantly, NEXE has put its pods through rigorous testing with third parties to confirm the compostability properties of their K-Cups, and indeed determined that while the fibrous exterior composts completely in the span of a few weeks, their PLA inner shell take the better part of 70 days in a composting facility. Note, anything under 84 days is considered compostable under most regulatory body guidelines, European and North American, and the Ontario government has endorsed the compostability of Club Coffee’s pods which also contain PLA.

At the end of the day the consumer wants a quality pour from their machine, and there are three main variables that determine a pours quality aside from the beans. Firstly, time to extract, which can be controlled by the shape of the K-Cup, the compaction of the grounds, and the grade of the mesh filter. Temperature, which is typically set by the machine and constant. Lastly, pressure, which while also set by the machine can be manipulated based on the compaction of the grounds and fineness of the mesh filter. NEXE can control all of these to fine tune their product to consistently deliver the best pour unlike Club Coffee and Maxwell House, their closest competitors, whom simply cannot due to the nature of their cup design.

While the short-term focus is the single-serve coffee market, there is a US$34 billion market for food, beverage, personal care and more that NEXE can pivot their existing materials technology to concentrate on. In collaboration with the University of British Columbia, the Government of Canada and various other research groups, NEXE is planning to grow their existing patent portfolio by 2021 to include the design and manufacturing of compostable products suitable as replacements for various containers, such as replacements for extruded plastics like yogurts, condiments, and other “snackables”.

The non-Competitive Landscape

Kraft Foods (Gevalia, Tassimo), Nestle (Nespresso, McCafe), and Keurig are all major competitors in this highly consolidated market space, with the top 5 brands holding around 50% of the market share. In 2020, Keurig and Nespresso will produce around 20 billion capsules and will classify all of them as recyclable. Both Keurig and Nespresso aren’t competing with NEXE on compostability, and neither is Rogers Family Coffee or Kraft Foods, so we consider NEXE to have a competitive moat as there are few incumbents and the barriers to entry from knowledge and technical expertise required is substantial.

Other more aligned competition does exist from smaller manufacturers, most notably Halo, Maxwell House, and Club Coffee, but unlike NEXE, these are not materials companies. Club Coffee and Maxwell House produce very similarly designed products; a paper lid, a PLA ring that is used to give shape and bind the lid, and a cornstarch or similar fiber mesh body that doubles as a filter.

There are a few issues with this design. Firstly, the mesh body doesn’t provide resistance to water the same way a rigid PLA cup would, which results in water being able to take paths that extract less coffee flavor than a regular pour. Also, the mesh body exposes the coffee grounds to air which oxidizes the grounds and degrades the quality of the grounds. Regardless of potentially lower quality coffee, Club Coffee’s first to market BPI Certified plant-based coffee pod has sold over a billion cups as of April 2020, and has built partnerships with Jumping Bean, Muskoka Roastery, McCafé and Presidents Choice. We think this demonstrates the current lack of options that consumers and companies face regarding compostability and confirms the sizeable addressable market that sustainable single-serve coffee pods are carving out.

Halo, a UK company, provides a 100% compostable Nespresso pod replacement made solely of sugar cane and paper pulp. This company is most similar to NEXE in that they’ve developed an alternative to the original Nespresso pod that’s compostable any retains the same quality form and function. There are drawbacks, as the sugar can and paper pulp is enough to withstand the Nespresso brewing machine but not much more, which is good because the product is biodegradable just about anywhere within a few weeks at regular temperatures, however, the shelf life is limited as the product isn’t capable of being airtight. This is a better engineered product than the Club Coffee and Maxwell House offerings, but like those other products it must be consumed within a shorter timeframe than traditional single-serve cups as exposure to air reduces its shelf life. Halo’s product comes at a premium of £1 per pod, or $1.72CAD, which is over double the price of a normal Nespresso pod at $0.78-0.86CAD.

Final Thoughts

People are becoming more knowledgeable about the products they consume and the way in which they are produced. Proof of this increased focus is the flow of capital into Environmental, Social and Governance (ESG) principle investing funds which have attracted $71.1 billion globally in the first half of 2020; that’s up from $20.6 billion in all of 2019, and twelve times the $5.5 billion that was pulled in 2018. In more obvious day-to-day examples, we see plastic straws being banned in favor of paper, restaurants being forced to use biodegradable packaging for takeout instead of plastics even though it’ll end up increasing costs to the customer and make transportation of certain foods harder. Society is moving towards using sustainable consumables.

Single-serve coffee is estimated to be growing at around a 7% CAGR over the next 4-6 years, and the near-term catalysts of working from home and self-isolation due to COVID disruptions make our $18-$20B addressable market for 2020 appear conservative. Small independent sustainable roasters will be looking to diversify their revenue streams as more consumers shop online and getting access to the single-serve coffee market that NEXE will provide would be an excellent way to achieve that.

The lack of meaningful competition and quality products have allowed an arguably inferior engineered product in Club Coffee to grow sales to around 1 billion pods in the span of a few years and now dominates the compostable pod segment. If NEXE can capture even 2% of the market that Club Coffee sells into (or 0.05% of the overall market), they would generate $10M in revenue. Management is targeting 0.22% overall market penetration by 2022, which brings them closer to $44M in annual sales.

NEXE already has approximately 12M of the 20M initial production capacity reserved by an independent roaster should NEXE meet certain design milestones. The near-term plan going to forward is to establish additional independent roasters as partners across Western Canada, California, and the Pacific Northwest as more lanes and production capability comes online.

Lastly, there is the significant value in the technology itself that NEXE has developed. NEXE will not only be able to generate revenues from licensing its technology regarding single-serve coffee but will grow it’s IP regarding assembling various organic materials in innovative ways to address the single-use plastics market as a whole. NEXE plans on being able to target food and beverage products like yogurt, fruit, soup, and more, doubling the total addressable market beyond single-serve coffee.